In explaining the unimpressive quarterly jobs data recently, there is a dangerous mythology surfacing, a common refrain among pundits, that people don’t want to work because of stimulus checks and extended unemployment benefits.

Some argue that unemployed low-wage workers make more from these benefits than from their previous employment. This may be true, but in my nearly 10-year tenure as CEO of what has become the nation’s largest publicly funded workforce development system, where we have facilitated training and employment of over 70,000 people, I have never once heard anyone say they didn’t want to work.

This is a harmful, corrosive narrative rooted in class, gender and race bias; it is a fallacy meant to demean and stigmatize.

The truth underlying what’s being touted as a “labor shortage” is far more nuanced than glib jabs at the working class. Examining reality invites us to reassess our beliefs about work and workers in this country.

"Those who make peaceful revolution impossible will make violent revolution inevitable." ~ John F. Kennedy

Showing posts with label stimulus. Show all posts

Showing posts with label stimulus. Show all posts

Sunday, August 8, 2021

The Dangerous Mythology About The US Labor Shortage

The dangerous mythology about the US labor shortage

Low Pay, No Benefits, Rude Customers: Restaurant Workers Quit At Record Rate

Friday, April 9, 2021

More Weekend Reading

DHS confirms Wisconsin to lose out on more than $50M in monthly federal food aid starting in MayBiden’s infrastructure plan would replace every lead pipe in MilwaukeeThe GOP, America’s most selfless political partyThe rise of working from homeJEN PSAKI STUFFS FOX NEWS’ PETER DOOCY IN METAPHORICAL LOCKER DURING WHITE HOUSE PRESS BRIEFINGWhere Are Real Estate Taxes Lowest (and Highest)?Republican legislative leaders want Josh Kaul to sue to allow state to use stimulus for tax cuts

Labels:

debt,

food aid,

GOP,

interstate highways,

Jen Psaki,

Kansas,

Newsmax,

Peter Doocy,

racism,

Ronald Reagan,

stimulus,

tax cuts,

taxes,

Wisconsin,

working from home

Friday, March 19, 2021

Weekend Reading

Republican lawmakers refuse to approve any building projects in Evers' $2.4 billion planKleefisch Spokesperson Compares Evers to DahmerNew Support for Friedman's Plucking ModelAnnouncer for high school basketball game uses racial slur after team kneels during anthemPrivate Schools Have Become Truly ObscenePelosi says GOP will vote against COVID-19 relief and then take credit for itA $60 billion surprise in the Covid relief bill: Tax hikesPandemic Bill Would Cut Taxes By An Average of $3,000, With Most Relief Going to Low- And Middle-Income Households.Helping Wisconsin Voters Would Be Harder—or Even a Criminal Act—in Some Republican ProposalsHere Are the 8 Democrats Who Just Joined GOP to Vote Down Sanders' $15 Minimum Wage Amendment

Saturday, February 13, 2021

Weekend Reading

Kenosha Judge Shrugs Off Kyle Rittenhouse’s Admitted Bond Violations, Denies Higher Bail And New WarrantSanders Responds to CBO Report on $15 Minimum WageCBO analysis confirms that a $15 minimum wage raises earnings of low-wage workers, reduces inequality, and has significant and direct fiscal effectsGOP senators criticized for appearing to pay half-hearted attention to trialMajority Of Those Arrested In Capitol Siege Had History Of Financial TroubleAs DeJoy Readies New Assault on Postal Service, Pressure Grows for Biden to 'Clean House'Further Means Testing of the Stimulus Will Be Disastrous for Suffering AmericansDid UW-Whitewater send Robin Vos and Steve Nass to Madison to act like grade schoolers?

Tuesday, May 19, 2020

Midweek Reading

Bryan Adams apologises after 'bat eating' coronavirus rant

Rand Paul Tells Dr. Anthony Fauci He Should Have a Little “Humility"

Gov. Tony Evers: GOP Leaders 'Unconcerned' About Patchwork Of COVID-19 Response How the Coronavirus is Killing the Middle Class Trump calls coronavirus testing ‘overrated,’ claims U.S. would have ‘very few’ cases if no testing Politicians failed us. So it's up to citizens to protect Wisconsin We could stop the pandemic by July 4 if the government took these steps The Great Lakes are higher than they’ve ever been, and we’re not sure what will happen next The 12 deadliest viruses on Earth See which states still have increasing rates of COVID-19

Rand Paul Tells Dr. Anthony Fauci He Should Have a Little “Humility"

Gov. Tony Evers: GOP Leaders 'Unconcerned' About Patchwork Of COVID-19 Response How the Coronavirus is Killing the Middle Class Trump calls coronavirus testing ‘overrated,’ claims U.S. would have ‘very few’ cases if no testing Politicians failed us. So it's up to citizens to protect Wisconsin We could stop the pandemic by July 4 if the government took these steps The Great Lakes are higher than they’ve ever been, and we’re not sure what will happen next The 12 deadliest viruses on Earth See which states still have increasing rates of COVID-19

Sunday, April 26, 2020

Sunday Reading

Here’s why the US can afford its high-priced pandemic rescue

Not Too Soon for Post-Pandemic Planning Conservative Groups Twist Coronavirus Facts

Trump Pulls Back Obama-Era Protections For Women Workers

At Least 40 COVID-19 Cases Tied to Election in Milwaukee Ohio man who disparaged lockdown measures on Facebook dies of coronavirus 40 Policies That Helped Pollute State

Not Too Soon for Post-Pandemic Planning Conservative Groups Twist Coronavirus Facts

Trump Pulls Back Obama-Era Protections For Women Workers

At Least 40 COVID-19 Cases Tied to Election in Milwaukee Ohio man who disparaged lockdown measures on Facebook dies of coronavirus 40 Policies That Helped Pollute State

Labels:

1918,

Barack Obama,

coronavirus,

COVID-19,

Donald Trump,

economy,

Milwaukee,

pandemic,

pollution,

racial divide,

Republicans,

stimulus,

welfare states

Wednesday, April 15, 2020

Midweek Reading

Foxconn's Buildings In Wisconsin Are Still Empty

The real reason Republicans ‘threw a fit in Wisconsin’

If the Postal Service Dies, So Does Democracy

GOP was giddy for low-turnout vote

Voter suppression now has a white face in Wisconsin

Why the Supreme Court’s contentious Wisconsin election ruling looks even worse now

The real reason Republicans ‘threw a fit in Wisconsin’

If the Postal Service Dies, So Does Democracy

GOP was giddy for low-turnout vote

Voter suppression now has a white face in Wisconsin

Why the Supreme Court’s contentious Wisconsin election ruling looks even worse now

Treasury stalls delivery of 70 million coronavirus stimulus checks to put Trump’s name on them

Its Not Capitalism, its Crony Capitalism

Capitalists or Cronyists?Its Not Capitalism, its Crony Capitalism

Some Companies Are Too Connected to Fail

A raging pandemic is showing the world how Republicans weaponize deficits and states’ rights against Democratic presidents

Tucker Carlson attacks Michelle Obama and says she’s trying to ‘destroy’ American democracyA raging pandemic is showing the world how Republicans weaponize deficits and states’ rights against Democratic presidents

Sunday, April 12, 2020

Saturday, March 25, 2017

Barack Obama One Of The Most Consequential Presidents In American History

Barack Obama is officially one of the most consequential presidents in American history

He signed into law a comprehensive national health insurance bill, a goal that had eluded progressive presidents for a century — and built it strong enough to withstand assaults from the Supreme Court and avoid repeal from a Republican administration. He got surprisingly tough reforms to Wall Street passed as well, not to mention a stimulus package that both blunted the recession and transformed education and energy policy.

He's put in place the toughest climate rules in American history and signed a major international climate accord. He opened the US to Cuba for the first time in more than half a century, and reached a peaceful settlement to the nuclear standoff with Iran.

Labels:

Barak Obama,

climate change,

Cuba,

economy,

energy,

health care,

Iran,

presidency,

stimulus,

United States,

Wall Street

Saturday, March 16, 2013

Weekend Reading

Austerity Kills Government Jobs As Cuts To Budgets Loom

Corporate Wellness Programs: Not Quite The Cost Savers

The Fanatic, Fraudulent Mother Teresa

Lost Decade Not Over For 401(k)s, IRAs

Morning Joe's Accuracy Deficit

Shocked, Shocked, Over Hospital Bills

The U.S. Economy Really Needs A $ 2 Trillion Stimulus

U.S. Power Grid Is Getting Pricier, Less Reliable

Voucher Madness

Corporate Wellness Programs: Not Quite The Cost Savers

The Fanatic, Fraudulent Mother Teresa

Lost Decade Not Over For 401(k)s, IRAs

Morning Joe's Accuracy Deficit

Shocked, Shocked, Over Hospital Bills

The U.S. Economy Really Needs A $ 2 Trillion Stimulus

U.S. Power Grid Is Getting Pricier, Less Reliable

Voucher Madness

Thursday, September 13, 2012

Crumbling Roads, Crumbling Democracy

Why is the economy continuing to only plod along? [But, yes, it is indeed better than it was 4 years ago.]

Why is unemployment looming stubbornly near 8 percent?

Paul Krugman explains:

"For future reference. In a depressed economy, with the government able to borrow at very low interest rates, we should be increasing public investment — the true cost of the resources is negligible, so the rate of return is very high, not to mention the desirability of creating jobs.

Here’s what has actually happened, as measured by the sum of state, local, and federal nondefense investment:

Doing it wrong."

Doing it wrong."

And, yes, Republican obstruction of all Obama's and the Democrat's jobs legislation has a lot to do with this.

According to Republicans, borrowing is bad, even though the cost of money is about as cheap as it gets. There isn't a better time to invest our infrastructure - mass transportation, water and sewer ways, the electric grid, the greening of public buildings, repairing bridges and roads, etc.

Also, according to Republicans, government-induced demand is a bad thing, although no one else (I'm looking at you, private sector) is willing to spend any money at the moment. Yes, for those of you being foreclosed upon, losing your job, already out of work, behind on your bills, you're just going to have to tough it out until the market decides you're worthy of saving.

Why is unemployment looming stubbornly near 8 percent?

Paul Krugman explains:

"For future reference. In a depressed economy, with the government able to borrow at very low interest rates, we should be increasing public investment — the true cost of the resources is negligible, so the rate of return is very high, not to mention the desirability of creating jobs.

Here’s what has actually happened, as measured by the sum of state, local, and federal nondefense investment:

And, yes, Republican obstruction of all Obama's and the Democrat's jobs legislation has a lot to do with this.

According to Republicans, borrowing is bad, even though the cost of money is about as cheap as it gets. There isn't a better time to invest our infrastructure - mass transportation, water and sewer ways, the electric grid, the greening of public buildings, repairing bridges and roads, etc.

Also, according to Republicans, government-induced demand is a bad thing, although no one else (I'm looking at you, private sector) is willing to spend any money at the moment. Yes, for those of you being foreclosed upon, losing your job, already out of work, behind on your bills, you're just going to have to tough it out until the market decides you're worthy of saving.

Friday, August 24, 2012

Saturday, August 18, 2012

Saturday, August 11, 2012

Weekend Reading

Comparing Housing Recoveries

Five Myths About Obama's Stimulus

Giving Economics A Bad Name

Looks Like Ryan: Mitt's Pick

Obamacare Benefits Are Starting To Roll Out

The Opportunity Cost Of Hoarding Cash Is Lower Than You Think

Ryan Wants Even Bigger Tax Cuts For Wealthy Than Romney

Where The World's Running Out Of Water

Five Myths About Obama's Stimulus

Giving Economics A Bad Name

Looks Like Ryan: Mitt's Pick

Obamacare Benefits Are Starting To Roll Out

The Opportunity Cost Of Hoarding Cash Is Lower Than You Think

Ryan Wants Even Bigger Tax Cuts For Wealthy Than Romney

Where The World's Running Out Of Water

Labels:

Barack Obama,

economics,

health care,

housing,

Mitt Romney,

Paul Ryan,

stimulus,

tax cuts,

water

Friday, July 27, 2012

Debt, Investment & America's Future

Debt, as a percentage of GDP, hasn't been this high since the Great Depression.

And?

Television personalities, pundits, supposed-experts, and other talking-heads are going on and on about how U.S. debt is dooming America.

Over the period following the Great Depression we heavily indebted ourselves to expand infrastructure, educate citizens, and to invest in our future...ending the Depression and moving America forward. From this period, with those large investments, the U.S. saw it's greatest period of prosperity and growth in our history. And, let me add, an income convergence. The middle class was created. The economy as a whole buzzed along, but rather than a select few taking most of the gains (like today), we enjoyed a shared prosperity where one breadwinner could support a family with a decent middle-class lifestyle (the American Dream); the boss made more, but not exponentially so, and the U.S. lifestyle and society were the envy of the world.

Schools, roadways, subdivisions, waterways, electrical grids, sewer systems, bridges ... almost every infrastructure, structural, and institutional entity embodying our national fabric - a majority of the things we now consider "the U.S." - were a direct result of those investments that were made to get out of the Depression.

[graph]

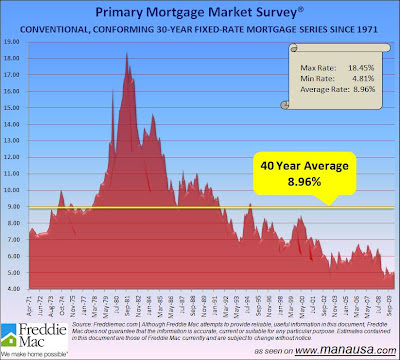

Interest rates are at historic lows. There is no better time to make infrastructure investments to propel us into another half-century of prosperity.

And?

Television personalities, pundits, supposed-experts, and other talking-heads are going on and on about how U.S. debt is dooming America.

Over the period following the Great Depression we heavily indebted ourselves to expand infrastructure, educate citizens, and to invest in our future...ending the Depression and moving America forward. From this period, with those large investments, the U.S. saw it's greatest period of prosperity and growth in our history. And, let me add, an income convergence. The middle class was created. The economy as a whole buzzed along, but rather than a select few taking most of the gains (like today), we enjoyed a shared prosperity where one breadwinner could support a family with a decent middle-class lifestyle (the American Dream); the boss made more, but not exponentially so, and the U.S. lifestyle and society were the envy of the world.

Schools, roadways, subdivisions, waterways, electrical grids, sewer systems, bridges ... almost every infrastructure, structural, and institutional entity embodying our national fabric - a majority of the things we now consider "the U.S." - were a direct result of those investments that were made to get out of the Depression.

[graph]

Interest rates are at historic lows. There is no better time to make infrastructure investments to propel us into another half-century of prosperity.

Saturday, April 28, 2012

Austerity U.S.A.

Paul Krugman - again - dismantles the meme of an expanding and frivolously spending government:

"Disappointing GDP number — we’re not growing fast enough to make any significant headway on reducing the output gap — but hey, no need for further Fed action.

But let’s talk right now about fiscal policy. I wrote this morning about our de facto austerity. Here’s another indicator. Look at government (all levels) purchases of goods and services, that is, actually buying stuff as opposed to transfer payments like Social Security and Medicare. Here’s the past decade:

Obama, far from presiding over a huge expansion of government the way the right claims, has in fact presided over unprecedented austerity, largely driven by cuts at the state and local level. And it’s therefore an amazing triumph of misinformation the way that lackluster economic performance has been interpreted as a failure of government spending."

But let’s talk right now about fiscal policy. I wrote this morning about our de facto austerity. Here’s another indicator. Look at government (all levels) purchases of goods and services, that is, actually buying stuff as opposed to transfer payments like Social Security and Medicare. Here’s the past decade:

Tuesday, February 21, 2012

The U.S, Debt & Households

In the media, when trying to practice "The Sky Is Falling" journalism (which is often), you'll see it said that the U.S. should act like a household. They shouldn't be in debt. They should balance their budget. They can't spend more than they take in. If the U.S. doesn't heed these warnings, Armageddon isn't far away.

Inspirational fear mongering aside, most U.S households don't to any of these prescriptions.

67% of U.S. homeowners have a mortgage. The median value for a home in the U.S. is $171,000. Per capita income is $26,000. So, let's assume the typical household with two adults is earning $52,000 per year. With a mortgage on eighty percent of the median home value, this is indebtedness of 2.6 times annual household earnings. And, this is just the house. Most households also have car, credit card, and medical debt.

The United States has a $15 trillion dollar economy. U.S debt is also estimated at $15 trillion. As a whole, the country is breaking even. Now a surplus would be nice, but compared to the typical U.S. household (in debt at least 2.6 times more than they earn, on average), breaking even seems pretty nice.

Inspirational fear mongering aside, most U.S households don't to any of these prescriptions.

67% of U.S. homeowners have a mortgage. The median value for a home in the U.S. is $171,000. Per capita income is $26,000. So, let's assume the typical household with two adults is earning $52,000 per year. With a mortgage on eighty percent of the median home value, this is indebtedness of 2.6 times annual household earnings. And, this is just the house. Most households also have car, credit card, and medical debt.

The United States has a $15 trillion dollar economy. U.S debt is also estimated at $15 trillion. As a whole, the country is breaking even. Now a surplus would be nice, but compared to the typical U.S. household (in debt at least 2.6 times more than they earn, on average), breaking even seems pretty nice.

Thursday, February 24, 2011

Cutting Is Completely Wrong

"I would argue that we don't have a budget crisis. We have a refusal to levy adequate taxation on those that can afford it "crisis" created by our politicians who refuse to raise taxes on the rich at at time in our history that resembles the Gilded Age with income disparity. As Sachs noted, we're going after discretionary spending which hits in is words, science, education, technology, and energy and he's exactly right on how our approach to what we should be cutting is completely wrong." [h/t Crooks and Liars]

Labels:

Crook and Liars,

Jeffrey Sachs,

spending,

state budgets,

stimulus

Friday, February 18, 2011

State & Local Shrinkage

More good reporting from Jon Perr:

- The USA net fiscal stimulus was modest relative to peers, despite being the epicenter of the crisis.

- Once you take state and local cutbacks into account, there was no surge in government spending.

- Local governments are cutting jobs at the fastest rate in almost 30 years.

- State and local governments has shed 407,000 jobs since August 2008.

Labels:

Jon Perr,

public sector,

States,

stimulus,

unemployment

Sunday, December 26, 2010

Public Appreciation

Grover Norquist, Chris Christie, Scott Walker, amongst many other conservative gasbags, are ramping up their efforts to belittle unionized public workers. They're selling their well-worn "privatization" snake oil as our savior; while blasting unions as our nemesis.

But, as I posted recently, aid to state and local governments is one of the five most stimulative spending initiatives the government can engage in. For every $1.00 invested in state and localities, $1.41 is returned. A very good bang for the buck.

Public workers not only provide services we all count on (even if they are rarely thought about or acknowledged by most citizens) but they also spend their earnings in their community - helping to create jobs, stabilize businesses, and support other economic activities.

As government has stepped aside over the past 40 years - with deregulation, less oversight, lower taxation, less unionization - we have seen a proportionate increase in inequality. More privatization and less government have been the trends pulling apart our society. To put this misguided strategy on steroids during the second worst economic downturn in history is suicide. If our goal is a continued concentration of wealth amongst a select few, this might be the way to go. If we'd rather experience a shared prosperity and increasing quality of life, we need government and unions to reassert their crucial role in our public dialogue and social contract.

The private sector, deregulation, the "business climate," the anti-tax cabal, and a host of other conservative "principles" have caused our volatile economy. It is time they stand-up and take responsibility for their actions. Where is their accountability? Their paradigm has handcuffed a generation with debt, low wages, no retirement, and no health care. And they want us to believe that more of this bogus worldview will, after failing for the past 40 years, suddenly, and finally, lead us to paradise.

The government and unions don't have all the answers. And, we can certainly find more efficiencies. We should remember this is true of the public AND private sector. But with government being the same size (when adjusted for population) as it was in the 1970s and with unions representing only 10 percent of the total working population, to keep blaming these two entities as the cause of all our fiscal problems is an exercise in elaborate delusion.

Unions and the government were largely responsible for the middle class. They enabled Social Security, Medicare, weekends, employer provided health care, pensions, labor and employment laws, minimum wages, workplace safety standards, amongst may other worker-friendly initiatives. As we've allowed more and more of the private sector to displace government and unions, we have seen a proportionate and precipitous decline in our quality of life, with an increasing amount of inequality.

This hyper-privatization, pro-business model has failed everyone but a select few. This is obviously not the answer. It's time we re-appreciate the public sector and the good that government can do for us all.

Labels:

economy,

government,

privatization,

stimulus,

unions

Subscribe to:

Posts (Atom)