Fed's Evans Questions March Toward Higher Interest Rates

America's Middle Class Is Vanishing. Nearly Half Of Workers Earn Less Than $30,000

A Historian Makes The Case Against Billionaires

Scientists Have Established A Link Between Brain Damage And Religious Fundamentalism

How Past Income Tax Rate Cuts On The Wealthy Affected The Economy

The Economics Of Soaking The Rich

How Marginal Tax Rates Actually Work, Explained With A Cartoon

The "Skills Gap" Was A Lie

Alexandria Ocasio-Cortez Is Floating A 70 Percent Top Tax Rate - Here's The Research That Backs Her Up

"Those who make peaceful revolution impossible will make violent revolution inevitable." ~ John F. Kennedy

Showing posts with label earnings. Show all posts

Showing posts with label earnings. Show all posts

Saturday, January 12, 2019

Sunday, September 4, 2016

Decline of Unions Has Hurt All Workers

Decline of unions has hurt all workers

The steep decline in union membership in recent decades has had an outsize effect on the American workforce, tamping down wage increases for nonunion workers, a new study says.

Average weekly earnings for nonunion private-sector male workers would have been 5%, or $52, higher in 2013 if the share of union workers had remained at 1979 levels, according to the study out Tuesday from the liberal-leaning Economic Policy Institute ahead of Labor Day. That’s tantamount to a loss of $2,704 annually for the average nonunion worker.

The paper was authored by Washington University sociologists Jake Rosenfeld and Patrick Denice, and Jennifer Laird, a research scientist at Columbia University’s Center on Poverty and Social Policy.

The earnings loss is smaller for women because they were not as unionized as men in 1979. Weekly wages would be about 2% to 3% higher for women if union membership had stayed at 1979 levels, the report says.

About 10% of male private-sector workers were union members in 2013, down from 34% in 1979. In that period, the share of women who belong to unions fell to 6% from 16%.

The report argues the dwindling influence of unions is a significant but often ignored reason for wage stagnation, along with globalization, technological change and the slowdown in educational achievement gains.

The prevalence of unions affects the pay of nonunion workers in various ways, the study says. Nonunion employers often raise their workers’ pay to foster loyalty and head off an organizing drive. Kodak deployed that strategy in highly organized New York State, the study says.

The fatter paychecks of union workers also creates a more competitive labor market that forces nonunion companies to lift wages to prevent employees from jumping ship. And unions often establish labor-friendly policies that generally promote fairness in pay, benefits and worker treatment, according to the report.

The gains of yesteryear were not limited to nonunion workers at risk of joining unions, the study says. When those workers received raises, their higher-level supervisors who couldn't join unions also saw sharper pay increases to maintain salary hierarchies, the paper says.

But the losses engendered by shrinking union participation are most pronounced for nonunion private-sector male workers who lack a Bachelor's degree. Wages for that group would be 8% higher in 2013 if union membership had stayed at 1979 levels, translating into an annual wage loss of $3,016.

Sunday, January 31, 2016

Union Decline Leads To Wage Decline For All

5 States Where the Middle Class Is Being Destroyed

CEO Pay, Unionization & The Middle Class

Unions, Public Sector & Wages

Wisconsin: -5.7%

The clear winner (or loser) in the race to the bottom has been Wisconsin, losing 5.7% of its middle class households since 2000. Average median income has dropped by roughly $9,000 annually, and costs of living have gone up as well. There have also been many political battles that have not worked in the middle class’s favor. Governor Scott Walker gutted many of the state’s unions — which has a big effect on the middle class — and all signs seem to indicate that he will aim to implement similar policies. Like Ohio, Wisconsin’s makeup was particularly vulnerable to a recession, and the proof is in the numbers.Union Membership In Wisconsin Plummets In Wake Of GOP Measures

In 2015, 8.3% of Wisconsin workers, or 223,000 in all, were members of unions. That was down sharply from the 306,000 people, or 11.7% of the state’s workforce, who belonged to unions in 2014.

For Further Reading:

Unions, Public Sector & Wages

Saturday, February 9, 2013

State/Local Versus Private-Sector Workers

State/Local Versus Private Sector Workers

Just wondering why these studies (like the one above) - the ones where academics actually look at the numbers and report on such - rarely are discussed in the Milwaukee Journal Sentinel. Every anecdotal story and "gut" feeling was paraded out in their reporting during Scott Walker's vilifying of public workers. The claims of excessive pay, overly generous benefits, etc. This was all reported as a given, a known fact.

It was, and is, nothing of the sort. Studies refuted it then, and they still refute it now.

Public workers are a bargain. Private workers doing the same work would cost you (at least) 4% more.

Putting aside job security, the calculations show that state/local benefits nearly offset the private sector wage premium, but compensation in the public sector is 4 percent less than that in the private sectorKey findings:

- State and local workers have a wage penalty of 9.5 percent.

- Pension contributions and retiree health insurance help close the gap.

- Total compensation for public sector workers is about 4 percent less than that in the private sector.

Just wondering why these studies (like the one above) - the ones where academics actually look at the numbers and report on such - rarely are discussed in the Milwaukee Journal Sentinel. Every anecdotal story and "gut" feeling was paraded out in their reporting during Scott Walker's vilifying of public workers. The claims of excessive pay, overly generous benefits, etc. This was all reported as a given, a known fact.

It was, and is, nothing of the sort. Studies refuted it then, and they still refute it now.

Public workers are a bargain. Private workers doing the same work would cost you (at least) 4% more.

Wednesday, April 25, 2012

U.S. Taxes Are Low & Regressive

Excerpted from Just How Progressive Is The U.S Tax Code:

"In this post we examine the progressivity of the U.S. tax code and highlight two facts: the current U.S. tax system is less progressive than the tax systems of other industrialized countries, and considerably less progressive today than it was just a few decades ago."

"This decline in tax rates for the wealthy has coincided with an increase in income inequality, where most of the wage gains have been concentrated among a relatively small portion of the American people. For example, since 1979, earnings for households in the top 1 percent of the income distribution have risen by over 250 percent. At the same time, many households at the middle and bottom of the income distribution have experienced stagnating incomes or even declines in earnings (figure below, blue bars). This means that the very people who have received the biggest income gains in the past three decades have also seen the largest tax cuts (figure below, red bars)."

"In this post we examine the progressivity of the U.S. tax code and highlight two facts: the current U.S. tax system is less progressive than the tax systems of other industrialized countries, and considerably less progressive today than it was just a few decades ago."

"Over the last fifty years, tax rates for the wealthiest Americans have declined by 40 percent, while tax rates for average Americans have remained roughly constant. This is illustrated in the figure below."

"But the reason why the share of taxes paid by the top 10 percent has increased is because their share of income has increased."

"In 1979, the top 1 percent of Americans earned 9.3 percent of all income in the United States and paid 15.4 percent of all federal taxes. While the share of income earned by the top 1 percent had more than doubled by 2007—to 19.4 percent—the share of federal tax liability paid by that group only increased by about 80 percent, to 28.1 percent. The share of taxes increased less for this group because high-income tax rates fell by more than the tax rates for everyone else—reductions that made the system less progressive."

Friday, July 1, 2011

Saturday, June 25, 2011

Public Versus Private? Or, Workers Versus Plutocrats

Corporate Profits are at historic levels. Yet, many corporations pay an effective tax rate of zero.

Although profits are up, workers are not sharing in the bounty of their productivity. Unemployment still remains near double digits.

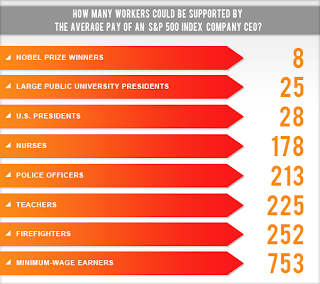

Executives are pulling in ludicrous pay, especially when compared to everyday workers.

Public sector workers total compensation as a share of state expenditures has declined over time. Workers, whether public or private, have been sacrificing. As their stagnating compensation clearly shows.

Public workers are highly educated. Nearly 60%, versus 30% for the private sector.

And, when actually compared for education and experience, public workers earn less. By bashing public workers, we are allowing the private sector to push down wages for all workers.

Productivity - output per unit of input - has climbed steadily. Workers are doing more. But they are not being rewarded. Compensation in the private and public sector has stagnated.

In every educational-attainment category, Wisconsin public workers earn less than their private sector counterparts.

In every educational-attainment category, Wisconsin public workers earn less than their private sector counterparts. The "it's the government and public workers fault" diversion we've witnessed over the past few years has been an elaborate mirage perpetrated by the creditors and financiers who've absconded so much of our nation's wealth over the past few decades.

The "it's the government and public workers fault" diversion we've witnessed over the past few years has been an elaborate mirage perpetrated by the creditors and financiers who've absconded so much of our nation's wealth over the past few decades. This is a classic from the conservative playbook - keeping Democrats fighting amongst themselves (public v private worker), while also delivering blows to the foundation of democratic policies and politics (unions). What do you know, everyone forgets that the uber rich are robbing us all blind. And now we're getting policies that are destroying our government and its institutions that help the majority of citizens. Instead, we're giving corporate tax breaks, downsizing regulatory agencies, privatizing our public educational system, and selling off public goods and services.

For those who still haven't heard, supply-side economics is a failure. Tax breaks do not pay for themselves. Raising taxes on the rich by 2% will not trigger Armageddon. The tax-cutting frenzy (specifically for the wealthy) over the past 40 years is the reason for our deficits and crumbling infrastructure. We don't have a spending problem, we have a revenue problem.

If we're looking for ways to fund the programs we all appreciate and the infrastructure we all depend on regularly, maybe we should be going where the money is - the CEOs and their corporations.

Labels:

CEO compensation,

Democrats,

earnings,

executive pay,

private sector,

public sector,

Republicans,

unions,

wages,

Wisconsin

Tuesday, December 21, 2010

The Undercompensated Public Employee

Public workers with a high school, some college, or an associates degree have average total compensation which is 6, 9, and 5 percent, respectively, better than equivalent private sector workers. All other categories of public worker suffer a compensation penalty when compared with their private sector cohorts. Overall, public workers total compensation is 3 percent less than their private sector counterparts. [Table courtesy of the Economic Policy Institute]

John Schmitt, of the Center for Economic & Policy Research, gives a breakdown of the educational attainment of public and private sector employees. One would imagine, since public sector workers are generally higher educated, that they would be compensated more, but they are not. "When state and local government employees are compared to private-sector workers with similar characteristics - particularly when workers are matched by age and education - state and local workers actually earn less, on average, than their private-sector counterparts. The wage penalty for working in the state-and-local sector is particularly large for higher-wage workers," Schmitt notes.

For Further Reading:

For Further Reading:

Labels:

compensation,

earnings,

public sector

Subscribe to:

Posts (Atom)