Rick Barrett informs, Impending Military Cuts Could Cost Wisconsin 11,000 Jobs.

Luckily, public sector jobs aren't real jobs (according to Republicans), so it doesn't matter.

For Further Reading:

Threats From Mounting Public Job Losses

Unemployment Rate Without Government Cuts: 1%

"Those who make peaceful revolution impossible will make violent revolution inevitable." ~ John F. Kennedy

Sunday, July 29, 2012

The Water Is Right Here

The Milwaukee Journal Sentinel has been critical of the City's dealings with Waukesha over diverting Lake Michigan water for Waukesha's "needs". This is another example of the Journal's approach to economic development - Just Do It! (Nevermind The Consequences).

Why should these naturally-advantaged locations [water] continue to subsidize and enable sprawling development, and their own decline, because of these suburban sprawlers' "needs"?

Isn't this exactly how those free-market Waukesha conservatives live their lives? Water is expensive because it's, more so, becoming a finite and localized resource. Supply and demand. What is the reasoning behind providing such water welfare to Waukesha?

Funny how such strongly held principles and world-views are so pliable when the advantage is in someone else's hands.

Just as those in Waukesha have been so helpful in promoting rail in the area. Or as they have been so helpful in employing inner-city residents with their suburban employment expansion over the past few decades.

Suddenly, sharing (socialist!) policies make good economic sense.

Work Until You're Dead

Christian Schneider, of the Journal Sentinel and WPRI, advises, Take It Slow On Pension Changes. This isn't the first time the Journal has allowed right-wing hacks to vilify and lead the way toward making our retirements more volatile.

But this begs the question, why make changes at all?

Wisconsin has the best - most solvent - pension system in the country.

Rather than taking it slow, better yet, leave it alone.

For Further Reading:

Deferred Wages

More Bad Pension Reporting

Pension & Retirement Reading

Pension Petulance

Politicking With Pensions

Recoiling Retirement

Retirement Revisionists

But this begs the question, why make changes at all?

Wisconsin has the best - most solvent - pension system in the country.

Rather than taking it slow, better yet, leave it alone.

For Further Reading:

Deferred Wages

More Bad Pension Reporting

Pension & Retirement Reading

Pension Petulance

Politicking With Pensions

Recoiling Retirement

Retirement Revisionists

Government Is A Bargain

Excerpt:

"Few consumers have noticed, but the federal government has essentially been on sale, with taxpayers paying about 20 percent less than they used to for what Washington does. Yet unlike satisfied customers, taxpayers are increasingly fed up with the government they finance. This could make them downright surly when the price of government goes back up, which is a near certainty over the next few years.

A new report published by the Congressional Budget Office shows that the average household paid 17.4 percent of its income to the federal government in the form of taxes in 2009, the latest data available.

That's the lowest tax burden on record. It's about 20 percent lower than the federal tax burden in 1979, when the CBO's data series began.

Government services, instead of falling in proportion to the amount of revenue Washington takes in, have instead expanded.

Over the last few years, in fact, taxpayers have been getting the best deal in modern times, in terms of what they get from the government, and what they pay for it.

The bigger point, however, is that the federal tax burden has been falling at every income level."

"Few consumers have noticed, but the federal government has essentially been on sale, with taxpayers paying about 20 percent less than they used to for what Washington does. Yet unlike satisfied customers, taxpayers are increasingly fed up with the government they finance. This could make them downright surly when the price of government goes back up, which is a near certainty over the next few years.

A new report published by the Congressional Budget Office shows that the average household paid 17.4 percent of its income to the federal government in the form of taxes in 2009, the latest data available.

That's the lowest tax burden on record. It's about 20 percent lower than the federal tax burden in 1979, when the CBO's data series began.

Government services, instead of falling in proportion to the amount of revenue Washington takes in, have instead expanded.

Over the last few years, in fact, taxpayers have been getting the best deal in modern times, in terms of what they get from the government, and what they pay for it.

The bigger point, however, is that the federal tax burden has been falling at every income level."

NOT Fannie, Freddie, the CRA, Nor The Poor

Republicans have been somewhat successful in diffusing the idea that Fannie Mae, Freddie Mac, the Community Reinvestment Act, and poor people were responsible for the housing bubble. Thus, Republicans are winning some elections, and our casino capitalism is still running amok.

Yet Ned Gramlich, of the Federal Reserve, found, "Banks have made many low- and moderate-income mortgages to fulfill their CRA obligations, they have found fault rates pleasantly low, and they generally charge low mortgage rates. Thirty years later, CRA has become very good business." Russel Kroszner, also of the Federal Reserve, states, "Contrary to the assertions of critics, the evidence does not support the view that the CRA contributed in any substantial way to the crisis in the subprime mortgage market."

For Further Reading:

Yet Ned Gramlich, of the Federal Reserve, found, "Banks have made many low- and moderate-income mortgages to fulfill their CRA obligations, they have found fault rates pleasantly low, and they generally charge low mortgage rates. Thirty years later, CRA has become very good business." Russel Kroszner, also of the Federal Reserve, states, "Contrary to the assertions of critics, the evidence does not support the view that the CRA contributed in any substantial way to the crisis in the subprime mortgage market."

As Paul Krugman explained, "The Community Reinvestment Act of 1977 was irrelevant to the subprime boom, which was overwhelmingly driven by loan originators not subject to the Act...During those same years [the middle years of the naughties], Fannie and Freddie were sidelined by Congressional pressure, and saw a drop in their share of securitization."

Neil Bhutta and Glenn B. Canner discovered, "The small share of subprime lending in 2005 and 2006 that can be linked to the CRA suggests it is very unlikely the CRA could have played a substantial role in the subprime crisis."

Kenneth Cooper notes, "In his new study on racial-ethnic lending patterns, Jourdain-Earl finds that Federal Reserve data show that 84 percent of mortgages purchased by Fannie Mae and Freddie Mac between 2004 and 2009 had been made to whites, with 8 percent going to Hispanics and 5 percent to African-Americans. For loans to comply with CRA, 68 percent went to whites, 15 percent to Hispanics and 12 percent to African-Americans—hardly enough volume from minorities to cause the housing crisis."

"Overall, loans originated for private-label securitization have defaulted at about six times the rate of Fannie and Freddie loans," informs David Min.

"Overall, loans originated for private-label securitization have defaulted at about six times the rate of Fannie and Freddie loans," informs David Min.

For Further Reading:

The definitive debunking of the "CRA, Fannie, Freddie, and the poor are at fault" claims can be read in Why Wallison Is Wrong About The Genesis Of The U.S Housing Crisis.

Ruinous Wall Street

"Plus, there's the fact that the entire industry continues to get preferential treatment from the government -- be it the $700 billion bailout in 2008 or the ongoing right to borrow massive amounts of essentially free money from the Federal Reserve, then turn around and loan it, risk free, to Uncle Sam at 1.5% or more per year, thus pocketing billions in easy money," reports Anthony Mirhaydari.

Saturday, July 28, 2012

Taxes, Voter Fraud & Campaign Finance

For Further Reading:

The Fraudulence Of Voter Fraud

The Myth Of Voter Fraud

The Voter Fraud Hoax

Voter ID Fact Sheet

Voter Identification

The Right To Vote & Voter Suppression

Voter Suppression

Labels:

campaign finance,

Ezra Klein,

Rachel Maddow,

taxes,

voter fraud

The Missing Link

It's good to (finally) see the Journal Sentinel clutching onto Richard Longworth's promotion of a more regional governance between Milwaukee and Chicago, and amongst other regional cities. But how long will this latest fascination last? Lip service (or should I say ink) to regionalism has flippantly been given by the Journal in the past.

Sadly, such communal (dare I say socialist) conceptions of government - cooperation for the benefit of the whole - whereby decisions are made with a broader concern have been brushed aside for decades by political and business leaders alike.

In 1992, looking at the potential positive regional impact from light rail transit (LRT), Marc Levine, professor of history and urban studies at UWM, found, "The UWMCED study concludes that, although the economic benefits of LRT should not be oversold and will require supportive public policies to be fully realized, a light rail system could contribute significantly to economic development in the city of Milwaukee and the entire region."

Levine, in reporting on Milwaukee's inner city in 2006, stated, "As a consequence of these trends, income inequality in metropolitan Milwaukee deepened last year, as the inner city fell further behind other areas of the region... These are massive income gaps that have widened considerably since 1990 and signify deep economic polarization in the region. “Regionalism” has become the new buzzword among city and corporate leaders, but, so far at least, there has been little indication that these leaders are prepared to implement the kinds of regional equity policies –in transportation, tax-base sharing, or growth management—that other communities have used to attack regional economic disparities."

In 2008, Levine proposed, "The region’s corporate leaders, represented by the Metropolitan Milwaukee Association of Commerce and the Greater Milwaukee Committee, supposedly support regional rail transit. If that’s true, they should make it the centerpiece of the Milwaukee 7 initiative, turning it into a more muscular regionalism that could underpin an economic revitalization of the city and region."

And, other voices have been calling for more regional approaches to governance for decades. Suddenly the Journal Sentinel is on board. Better late than never, I guess.

The problem is that by opposing rail (and other more regional - cooperative - policies), the Journal Sentinel has stymied progress on the very issue they suddenly see as a no-brainer. Rail would-have-been an catalyst for infrastructure, jobs, and an improved regional linkage. It would have been one of the biggest investments in the region in a generation or more.

The Journal Sentinel goose-stepped right along with Scott Walker and his plan to refuse funding for rail expansion in the region.

Milquetoast coverage and the occasional blip regarding a "regional" solution to the issue-of-the-moment is not full-throated support for regionalism nor meaningfully helpful in bringing regional governance, as a topic, to the forefront.

It's hard to claim to be for the region when one supports policies that prevent the region from more efficiently linking together and growing.

Sadly, such communal (dare I say socialist) conceptions of government - cooperation for the benefit of the whole - whereby decisions are made with a broader concern have been brushed aside for decades by political and business leaders alike.

In 1992, looking at the potential positive regional impact from light rail transit (LRT), Marc Levine, professor of history and urban studies at UWM, found, "The UWMCED study concludes that, although the economic benefits of LRT should not be oversold and will require supportive public policies to be fully realized, a light rail system could contribute significantly to economic development in the city of Milwaukee and the entire region."

Levine, in reporting on Milwaukee's inner city in 2006, stated, "As a consequence of these trends, income inequality in metropolitan Milwaukee deepened last year, as the inner city fell further behind other areas of the region... These are massive income gaps that have widened considerably since 1990 and signify deep economic polarization in the region. “Regionalism” has become the new buzzword among city and corporate leaders, but, so far at least, there has been little indication that these leaders are prepared to implement the kinds of regional equity policies –in transportation, tax-base sharing, or growth management—that other communities have used to attack regional economic disparities."

In 2008, Levine proposed, "The region’s corporate leaders, represented by the Metropolitan Milwaukee Association of Commerce and the Greater Milwaukee Committee, supposedly support regional rail transit. If that’s true, they should make it the centerpiece of the Milwaukee 7 initiative, turning it into a more muscular regionalism that could underpin an economic revitalization of the city and region."

And, other voices have been calling for more regional approaches to governance for decades. Suddenly the Journal Sentinel is on board. Better late than never, I guess.

The problem is that by opposing rail (and other more regional - cooperative - policies), the Journal Sentinel has stymied progress on the very issue they suddenly see as a no-brainer. Rail would-have-been an catalyst for infrastructure, jobs, and an improved regional linkage. It would have been one of the biggest investments in the region in a generation or more.

The Journal Sentinel goose-stepped right along with Scott Walker and his plan to refuse funding for rail expansion in the region.

Milquetoast coverage and the occasional blip regarding a "regional" solution to the issue-of-the-moment is not full-throated support for regionalism nor meaningfully helpful in bringing regional governance, as a topic, to the forefront.

It's hard to claim to be for the region when one supports policies that prevent the region from more efficiently linking together and growing.

The Good Government Does, Yet Another Example

I just received a letter from my health insurance provider.

The Affordable Care Act ("Obamacare") requires insurance companies to rebate part of the premiums it receives if it does not spend at least 85 percent of the premiums on health care services.

In this case, they only spent 84 percent, thus they have to rebate 1 percent of the total health insurance premiums paid the the employer and employees in the group health plan.

Yet another example of how President Obama's health reforms are actually working. Many would have preferred universal coverage - Medicare for all. But at least we're headed in the right direction.

The alternative is continuing to pay comparatively outrageous fees for our health care while receiving no better care, and also having to deal with the millions of citizens that otherwise would be without any health care coverage (other than emergency rooms, which cost even more).

[source]

[source]

What do Republicans want? What is their alternative, better plan? "Obamacare" seems to work. What are they opposed to?

Update:

Hmmm, so rising health care costs are the fault of Medicare/Medicaid, Health Maintenance Organizations, socialism, and the government, in general (according to a commenter).

How can nearly every other developed country in the world provide better quality health care, at half the cost, in what are much more "socialized" systems than ours? The answer isn't more "market," it's less. Medicare already controls costs better than the private sector. Removing private insurers and their greed from the equation would bring American health care costs in-line with the rest of the world.

Markets work nicely for socks and widgets, but not so much for health care. For you, "Anonymous," read and learn:

Why We Need An Individual Mandate For Health Care

Why Markets Can't Cure Health Care

Uncertainty & The Welfare Economics Of Medical Care

The Market For Lemons

The Affordable Care Act ("Obamacare") requires insurance companies to rebate part of the premiums it receives if it does not spend at least 85 percent of the premiums on health care services.

In this case, they only spent 84 percent, thus they have to rebate 1 percent of the total health insurance premiums paid the the employer and employees in the group health plan.

Yet another example of how President Obama's health reforms are actually working. Many would have preferred universal coverage - Medicare for all. But at least we're headed in the right direction.

The alternative is continuing to pay comparatively outrageous fees for our health care while receiving no better care, and also having to deal with the millions of citizens that otherwise would be without any health care coverage (other than emergency rooms, which cost even more).

[source]

[source]

What do Republicans want? What is their alternative, better plan? "Obamacare" seems to work. What are they opposed to?

Update:

Hmmm, so rising health care costs are the fault of Medicare/Medicaid, Health Maintenance Organizations, socialism, and the government, in general (according to a commenter).

How can nearly every other developed country in the world provide better quality health care, at half the cost, in what are much more "socialized" systems than ours? The answer isn't more "market," it's less. Medicare already controls costs better than the private sector. Removing private insurers and their greed from the equation would bring American health care costs in-line with the rest of the world.

Markets work nicely for socks and widgets, but not so much for health care. For you, "Anonymous," read and learn:

Why We Need An Individual Mandate For Health Care

Why Markets Can't Cure Health Care

Uncertainty & The Welfare Economics Of Medical Care

The Market For Lemons

Conflict Of Interest

Republicans Shorting Treasury Bonds, Would Profit From Government Defaults

If your job is to shape policies that benefit America (or at least not contribute to the U.S.'s insolvency), I'm sure you're not doing anything opposed to such, especially something to worsen the situation, even if your portfolio would benefit from those actions.

Truly great public servants.

If your job is to shape policies that benefit America (or at least not contribute to the U.S.'s insolvency), I'm sure you're not doing anything opposed to such, especially something to worsen the situation, even if your portfolio would benefit from those actions.

Truly great public servants.

Labels:

government,

Republicans,

short selling,

U.S. Treasuries

Friday, July 27, 2012

Debt, Investment & America's Future

Debt, as a percentage of GDP, hasn't been this high since the Great Depression.

And?

Television personalities, pundits, supposed-experts, and other talking-heads are going on and on about how U.S. debt is dooming America.

Over the period following the Great Depression we heavily indebted ourselves to expand infrastructure, educate citizens, and to invest in our future...ending the Depression and moving America forward. From this period, with those large investments, the U.S. saw it's greatest period of prosperity and growth in our history. And, let me add, an income convergence. The middle class was created. The economy as a whole buzzed along, but rather than a select few taking most of the gains (like today), we enjoyed a shared prosperity where one breadwinner could support a family with a decent middle-class lifestyle (the American Dream); the boss made more, but not exponentially so, and the U.S. lifestyle and society were the envy of the world.

Schools, roadways, subdivisions, waterways, electrical grids, sewer systems, bridges ... almost every infrastructure, structural, and institutional entity embodying our national fabric - a majority of the things we now consider "the U.S." - were a direct result of those investments that were made to get out of the Depression.

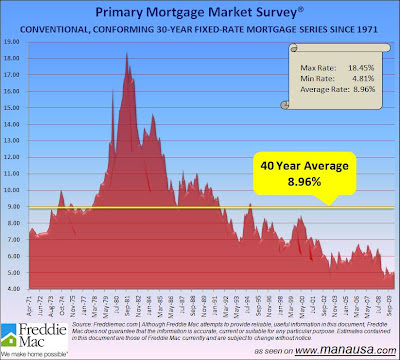

[graph]

Interest rates are at historic lows. There is no better time to make infrastructure investments to propel us into another half-century of prosperity.

And?

Television personalities, pundits, supposed-experts, and other talking-heads are going on and on about how U.S. debt is dooming America.

Over the period following the Great Depression we heavily indebted ourselves to expand infrastructure, educate citizens, and to invest in our future...ending the Depression and moving America forward. From this period, with those large investments, the U.S. saw it's greatest period of prosperity and growth in our history. And, let me add, an income convergence. The middle class was created. The economy as a whole buzzed along, but rather than a select few taking most of the gains (like today), we enjoyed a shared prosperity where one breadwinner could support a family with a decent middle-class lifestyle (the American Dream); the boss made more, but not exponentially so, and the U.S. lifestyle and society were the envy of the world.

Schools, roadways, subdivisions, waterways, electrical grids, sewer systems, bridges ... almost every infrastructure, structural, and institutional entity embodying our national fabric - a majority of the things we now consider "the U.S." - were a direct result of those investments that were made to get out of the Depression.

[graph]

Interest rates are at historic lows. There is no better time to make infrastructure investments to propel us into another half-century of prosperity.

Monday, July 23, 2012

Monday, July 16, 2012

More Republican Hypocrisy

As Michael McAuliff reports, "When Congress passed the health care law, it required members of Congress to get their insurance on exchanges with the rest of the public. But in voting to repeal that law, Republicans and a handful of Democrats were also voting to go back to the old system where the lawmakers get a sweeter deal than most of the rest of the country. They also voted against a Democratic motion that said members of Congress who support repealing the health care law must also repeal the good stuff they get, such as lifetime care and insurance regardless of pre-existing conditions."

"House Republicans refuse to admit they voted to give themselves taxpayer funded lifetime guaranteed health care instead of having the same health care as their constituents," said Jesse Ferguson, spokesman for the Democratic Congressional Campaign Committee, referring to the fact that members of Congress are eligible for retirement benefits after just five years. "House Republicans didn’t just vote to protect insurance company campaign donor profits this time, they’re even helping themselves to lifetime taxpayer-funded government health care and now they need to be honest with their constituents and admit it,” Ferguson said.

Labels:

Affordable Care Act,

health care,

hypocrisy,

Republicans

Saturday, July 14, 2012

Milwaukee: Open For Business

Who would have thought (considering its relatively small size and after listening to Scott Walker talk about how scary Milwaukee is) that Milwaukee is well-represented with Fortune 500 companies.

And, just as a reminder/primer on all the widely-known companies that just so happen to be from Wisconsin, here's a partial list:

- Johnson Controls

- Northwestern Mutual Life Insurance Co.

- Manpower Inc.

- Kohl's Corp.

- GE Healthcare

- American Family Insurance Co.

- S.C. Johnson & Sons Inc.

- Menard Inc.

- Harley-Davidson

- Rockwell Automation

- Roundy's Inc.

- Miller Brewing Co.

- Fiserv Inc.

- WE Energies

- ShopKo Stores Inc.

- Kohler Co.

- Briggs & Stratton Corp.

- Humana Insurance Co.

- Snap-On Inc.

- Land's End

- Aurora Health Care Inc.

- Quad/Graphics

- A.O. Smith Corp.

- Kwik Trip Inc.

- Famous Footwear

- Blue Cross & Blue Shield United

- Jockey International Inc.

- Sargento Foods Inc.

- Milwaukee Electric Tool Corp.

Labels:

Fortune 500,

Milwaukee,

Scott Walker,

Wisconsin

Mitt "O.G." Romney

Republicans have been beating on the idea that Unions are the worst. (Eyes off the 1%.) Yes, those unionized bastards living a seemingly middle-class lifestyle are living the high life. They are thugs...undeserving barbarians. Do-nothings living off the government teat.

Enter Mitt Romney.

Rachel Maddow has a great expose(s) on this O.G. The most outlandishly gangsta thug out there.

If we want to see an entitled, do-nothing slug living off the public teat (or the benefits obtained from politically buying such) look no further than Thug Romney.

Enter Mitt Romney.

Rachel Maddow has a great expose(s) on this O.G. The most outlandishly gangsta thug out there.

Prognosis Negative

It's about time. Walker M.D. is on the case.

We've been having an arduous debate over health care reform. Now that reform has passed and been solidified by the Supreme Court, Scott Walker has weighed in with his opinion of what the results will be for Wisconsin.

Yes, with his well-known expertise in health care economics, Walker foresees trouble ahead for Wisconsin and America. Yes, Mr. Walker's medical and economics degrees sure do come in handy in this situation. Oh, wait...

[Even Tommy Thompson (outfitted with a Harley motorcycle and all) is running campaign ads promising to repeal health care reform.]

Um, yeah, so this isn't really well-reasoned analysis pursued in the interest of what's best for citizens and their health care. This is the Republican party marching-orders. Repealing "Obama" care is a central theme for Republicans in the next election cycle. Everyone running as a Republican will be running ads and writing op-eds talking about how bad "Obama" care is and how they will save their constituents by overturning it.

In all the smoke and mirrors, one thing every citizen should remember is this: Republicans are interested in power NOT policy. They want to be the ones in charge, able to use the government to reward cronies and steer taxpayer dollars toward their pet projects. These aren't well-intentioned individuals concerned with the economy, health care, clean water, etc. In fact, Republicans direct opposition to every initiative the Democrats have proposed - which attempt to benefit the poor, the middle-class, workers, the elderly, etc. - should make it very clear that the Republicans aren't concerned with the welfare of the majority of citizens.

I had to laugh at Walker's article's statement, "The best place to see the effects of the law is in our nation's laboratories, the states." Having written this, one would then assume Mr. Walker was going to talk about Massachusetts, which developed the nation's only universal health coverage system six years ago. Nope, instead he rambled on about his own recently passed budget and all its mythical savings.

And, of course Walker had to insert the idea of people "becoming dependent on the government and taxpayers." Because whenever the government taxes, regulates, or does anything, in the view of Republicans, it's merely a roundabout path toward an increase in lay-abouts dependent on the government. Yes, health care reform is simply a nefarious idea to increase costs, according to the Republicans. Democrats want a centralized country (Socialists!) where do-nothings get all the breaks and the hard workers pay for it. Or, at least, this is the red-baiting tactic Republicans are claiming and counting on. Most Republicans are unaware the government spending already accounts for nearly half of all health care costs (43.6 percent of all health care spending in the U.S. in 2009).

As Paul Krugman explains, "Well, if having the government regulate and subsidize health insurance is a “takeover,” that takeover happened long ago. Medicare, Medicaid, and other government programs already pay for almost half of American health care, while private insurance pays for barely more than a third (the rest is mostly out-of-pocket expenses). And the great bulk of that private insurance is provided via employee plans, which are both subsidized with tax exemptions and tightly regulated."

Regarding the supposed cost increases Republicans are claiming due to health care reform, Jonathan Chait clarifies, "The Affordable Care Act spends a bunch of money to cover people who are too poor or sick to afford their own health care. To pay for that, it raises some taxes and cuts a bunch of spending from Medicare. The new revenue and the spending cuts outweigh the cost of the new spending, which is why the Congressional Budget Office projected it to reduce the deficit. Projections always have a margin for error attached, but the CBO’s two year update actually bumped up the savings projections a bit."

So, as usual, Republicans are living in an alternate (false) reality. The Affordable Care Act is actually predicted to decrease health care costs over time. Trying to control health care costs while covering more people is not a socialist plot, it is an attempt at a more cost-effective, moral and healthy society.

Government is us. And, it can do (and already does) many things very well for a majority of citizens. Don't let the Republicans try to convince you otherwise.

For Further Reading:

CBO Update Shows Lower Costs For Health Care Law

Uncertainty & The Welfare Economics Of Medical Care

We've been having an arduous debate over health care reform. Now that reform has passed and been solidified by the Supreme Court, Scott Walker has weighed in with his opinion of what the results will be for Wisconsin.

Yes, with his well-known expertise in health care economics, Walker foresees trouble ahead for Wisconsin and America. Yes, Mr. Walker's medical and economics degrees sure do come in handy in this situation. Oh, wait...

[Even Tommy Thompson (outfitted with a Harley motorcycle and all) is running campaign ads promising to repeal health care reform.]

Um, yeah, so this isn't really well-reasoned analysis pursued in the interest of what's best for citizens and their health care. This is the Republican party marching-orders. Repealing "Obama" care is a central theme for Republicans in the next election cycle. Everyone running as a Republican will be running ads and writing op-eds talking about how bad "Obama" care is and how they will save their constituents by overturning it.

In all the smoke and mirrors, one thing every citizen should remember is this: Republicans are interested in power NOT policy. They want to be the ones in charge, able to use the government to reward cronies and steer taxpayer dollars toward their pet projects. These aren't well-intentioned individuals concerned with the economy, health care, clean water, etc. In fact, Republicans direct opposition to every initiative the Democrats have proposed - which attempt to benefit the poor, the middle-class, workers, the elderly, etc. - should make it very clear that the Republicans aren't concerned with the welfare of the majority of citizens.

I had to laugh at Walker's article's statement, "The best place to see the effects of the law is in our nation's laboratories, the states." Having written this, one would then assume Mr. Walker was going to talk about Massachusetts, which developed the nation's only universal health coverage system six years ago. Nope, instead he rambled on about his own recently passed budget and all its mythical savings.

And, of course Walker had to insert the idea of people "becoming dependent on the government and taxpayers." Because whenever the government taxes, regulates, or does anything, in the view of Republicans, it's merely a roundabout path toward an increase in lay-abouts dependent on the government. Yes, health care reform is simply a nefarious idea to increase costs, according to the Republicans. Democrats want a centralized country (Socialists!) where do-nothings get all the breaks and the hard workers pay for it. Or, at least, this is the red-baiting tactic Republicans are claiming and counting on. Most Republicans are unaware the government spending already accounts for nearly half of all health care costs (43.6 percent of all health care spending in the U.S. in 2009).

As Paul Krugman explains, "Well, if having the government regulate and subsidize health insurance is a “takeover,” that takeover happened long ago. Medicare, Medicaid, and other government programs already pay for almost half of American health care, while private insurance pays for barely more than a third (the rest is mostly out-of-pocket expenses). And the great bulk of that private insurance is provided via employee plans, which are both subsidized with tax exemptions and tightly regulated."

Regarding the supposed cost increases Republicans are claiming due to health care reform, Jonathan Chait clarifies, "The Affordable Care Act spends a bunch of money to cover people who are too poor or sick to afford their own health care. To pay for that, it raises some taxes and cuts a bunch of spending from Medicare. The new revenue and the spending cuts outweigh the cost of the new spending, which is why the Congressional Budget Office projected it to reduce the deficit. Projections always have a margin for error attached, but the CBO’s two year update actually bumped up the savings projections a bit."

So, as usual, Republicans are living in an alternate (false) reality. The Affordable Care Act is actually predicted to decrease health care costs over time. Trying to control health care costs while covering more people is not a socialist plot, it is an attempt at a more cost-effective, moral and healthy society.

Government is us. And, it can do (and already does) many things very well for a majority of citizens. Don't let the Republicans try to convince you otherwise.

For Further Reading:

CBO Update Shows Lower Costs For Health Care Law

Uncertainty & The Welfare Economics Of Medical Care

Sunday, July 8, 2012

Wasteful Corporate Welfare

More corporate welfare is shown to be ineffective...

The Lincoln Institute of Land Policy's latest report, Rethinking Property Tax Incentives For Business, finds:

The use of property tax incentives for business by local governments throughout the United States has escalated over the last 50 years. While there is little evidence that these tax incentives are an effective instrument to promote economic development, they cost state and local governments $5 to $10 billion each year in forgone revenue.

Three major obstacles can impede the success of property tax incentives as an economic development tool. First, incentives are unlikely to have a significant impact on a firm’s profitability since property taxes are a small part of the total costs for most businesses—averaging much less than 1 percent of total costs for the U.S. manufacturing sector. Second, tax breaks are sometimes given to businesses that would have chosen the same location even without the incentives. When this happens, property tax incentives merely deplete the tax base without promoting economic development. Third, widespread use of incentives within a metropolitan area reduces their effectiveness, because when firms can obtain similar tax breaks in most jurisdictions, incentives are less likely to affect business location decisions.

Despite a generally poor record in promoting economic development, property tax incentives continue to be used. The goal is laudable: attracting new businesses to a jurisdiction can increase income or employment, expand the tax base, and revitalize distressed urban areas. In a best case scenario, attracting a large facility can increase worker productivity and draw related firms to the area, creating a positive feedback loop. This report offers recommendations to improve the odds of achieving these economic development goals.

Wisconsin Economic Development: Walker's Untraceable Slush Fund

What a novel idea...actually holding someone accountable for the things they claim they will do.

"Wisconsin's Legislative Audit Bureau found that stat government agencies have incomplete data on the impact of economic development programs they administer."

"In the 2007-'11 period, state agencies administered 196 economic development programs, according to the report. But state auditors said it was difficult to determine how many jobs actually had resulted from the programs."

Ah, the beauty of nepotism and cronyism. I guess this is what should be expected when private interests dominate public agencies.

The article goes on to note, "Last July, the Commerce Department was abolished and replaced with the partially privatized Wisconsin Economic Development Corp. But a new state law reduced the the information on program results the state agencies must report to the Legislature annually."

Yes, after privatizing a public agency, less information is required. We are using public dollars to fund private ventures, and we are now requiring less information on the results of those investments. How is this an improvement in any way? How can we evaluate what works if we don't monitor what's going on?

"Among information no longer required are quantifiable performance measures directly related to a programs' purpose, including the number of jobs created or retained in each industry and in each municipality in the prior fiscal year. Also, agencies aren't required to report the amount of tax benefits allocated - nor the recipients of them - under the new rules."

Sounds like certain politicians (yes, I'm looking at you Scott Walker) have set up an untraceable quasi-private slush-fund to funnel money to cronies. So much for the era of transparent government and doing what's in the best interest of the people. So much for wisely spending public dollars.

I hope to see a lot more stories about this. I hope to see journalists questioning the Walker administration about this. It may not be corrupt, but everything on the surface seems to indicate this whole apparatus is nothing but an undetectable payback machine for well-connected political supporters.

How can Scott Walker plan to know which development policies are working if records aren't kept on the costs and the rewards (or losses)? How can we make meaningful decisions and adjustments if benchmarking isn't done? It almost seems ludicrous that such seemingly corrupt and unmeasurable practices are now codified into state operations.

For Further Reading:

Evaluation of Online Economic Development Subsidy Information

Evaluation of State Economic Development Subsidy Disclosure

Money Back Guarantees For Taxpayers

Money For Something

The Risk of Privatizing State Economic Development Agencies

Targeting Ineffective Economic Development Subsidies

"Wisconsin's Legislative Audit Bureau found that stat government agencies have incomplete data on the impact of economic development programs they administer."

"In the 2007-'11 period, state agencies administered 196 economic development programs, according to the report. But state auditors said it was difficult to determine how many jobs actually had resulted from the programs."

Ah, the beauty of nepotism and cronyism. I guess this is what should be expected when private interests dominate public agencies.

The article goes on to note, "Last July, the Commerce Department was abolished and replaced with the partially privatized Wisconsin Economic Development Corp. But a new state law reduced the the information on program results the state agencies must report to the Legislature annually."

Yes, after privatizing a public agency, less information is required. We are using public dollars to fund private ventures, and we are now requiring less information on the results of those investments. How is this an improvement in any way? How can we evaluate what works if we don't monitor what's going on?

"Among information no longer required are quantifiable performance measures directly related to a programs' purpose, including the number of jobs created or retained in each industry and in each municipality in the prior fiscal year. Also, agencies aren't required to report the amount of tax benefits allocated - nor the recipients of them - under the new rules."

Sounds like certain politicians (yes, I'm looking at you Scott Walker) have set up an untraceable quasi-private slush-fund to funnel money to cronies. So much for the era of transparent government and doing what's in the best interest of the people. So much for wisely spending public dollars.

I hope to see a lot more stories about this. I hope to see journalists questioning the Walker administration about this. It may not be corrupt, but everything on the surface seems to indicate this whole apparatus is nothing but an undetectable payback machine for well-connected political supporters.

How can Scott Walker plan to know which development policies are working if records aren't kept on the costs and the rewards (or losses)? How can we make meaningful decisions and adjustments if benchmarking isn't done? It almost seems ludicrous that such seemingly corrupt and unmeasurable practices are now codified into state operations.

For Further Reading:

Evaluation of Online Economic Development Subsidy Information

Evaluation of State Economic Development Subsidy Disclosure

Money Back Guarantees For Taxpayers

Money For Something

The Risk of Privatizing State Economic Development Agencies

Targeting Ineffective Economic Development Subsidies

More Bad Pension Reporting

The Journal Sentinel's PolitiFact Wisconsin deemed Marty Beil's (executive director AFSCME) description of the state pension plan being self-funded as "mostly false".

Then, after numerous contortions and rhetorical gymnastics, the articles itself states, "Pensions are an integral part of an employee’s compensation package. In effect, it is money set aside now to be available when the worker retires. "It’s not like they’re giving it to us," said Susan McMurray (AFSCME lobbyist Council 11), who spoke for Beil. This point of view was advocated during the original collective bargaining debate by financial journalist David Cay Johnston. "The money the state ‘contributes’ is actually part of the compensation that has been negotiated with state workers in advance so it is their money that they choose to take as pension payments in the future rather than cash wages or other benefits today," Johnston wrote in a 2011 article for Tax.com."

At the end of the day, contributions by the state - the employer of state public workers - are part of the workers' overall compensation. These are terms negotiated in the workers' contracts. Rather than demanding a higher wage, the workers forego hourly pay in exchange for a pension contribution. It's actually the workers' deferred wages being used to fund the pension plan. Pretty straight forward concept.

The employer - the state - places a certain percentage of earnings into a retirement account. They can either do this or pay the worker the equivalent more per hour. Is this too complicated for PolitiFact to understand?

I guess this is just another attempt at sensationalistic journalism with the well-worn theme of union bashing.

How PolitiFact can conclude that the pension plan being self-funded is mostly false is totally bullshit.

Then, after numerous contortions and rhetorical gymnastics, the articles itself states, "Pensions are an integral part of an employee’s compensation package. In effect, it is money set aside now to be available when the worker retires. "It’s not like they’re giving it to us," said Susan McMurray (AFSCME lobbyist Council 11), who spoke for Beil. This point of view was advocated during the original collective bargaining debate by financial journalist David Cay Johnston. "The money the state ‘contributes’ is actually part of the compensation that has been negotiated with state workers in advance so it is their money that they choose to take as pension payments in the future rather than cash wages or other benefits today," Johnston wrote in a 2011 article for Tax.com."

At the end of the day, contributions by the state - the employer of state public workers - are part of the workers' overall compensation. These are terms negotiated in the workers' contracts. Rather than demanding a higher wage, the workers forego hourly pay in exchange for a pension contribution. It's actually the workers' deferred wages being used to fund the pension plan. Pretty straight forward concept.

The employer - the state - places a certain percentage of earnings into a retirement account. They can either do this or pay the worker the equivalent more per hour. Is this too complicated for PolitiFact to understand?

I guess this is just another attempt at sensationalistic journalism with the well-worn theme of union bashing.

How PolitiFact can conclude that the pension plan being self-funded is mostly false is totally bullshit.

Labels:

Marty Beil,

Milwaukee Journal Sentinel,

pensions,

PolitiFact,

retirement,

unions,

Wisconsin

Monday, July 2, 2012

Monday Reading

The Anti-Union Roberts Court

Corporate Profits Hit All-Time High, Wages Hit All-Time Low

Declining Number Of Union Members Affects All Workers' Salaries

11 Facts About The Affordable Care Act

5 Reasons America Has Never Been A Christian Nation

The Great American Mirage

A Manifesto For Economic Sense

The Myth Of The Free Market

The Myth That Entitlements Ruin Countries

Public Workers & Unions Are Not Overpaid

Corporate Profits Hit All-Time High, Wages Hit All-Time Low

Declining Number Of Union Members Affects All Workers' Salaries

11 Facts About The Affordable Care Act

5 Reasons America Has Never Been A Christian Nation

The Great American Mirage

A Manifesto For Economic Sense

The Myth Of The Free Market

The Myth That Entitlements Ruin Countries

Public Workers & Unions Are Not Overpaid

Labels:

corporate profits,

economy,

entitlements,

free market,

health care,

John Roberts,

religion,

Supreme Court,

unions,

wages

Subscribe to:

Posts (Atom)