"Those who make peaceful revolution impossible will make violent revolution inevitable." ~ John F. Kennedy

Wednesday, March 30, 2011

Job Destruction

Saturday, March 26, 2011

Right-Wing Ruthlessness

Watch What You Say

Friday, March 25, 2011

Stay Classy, Right-Wing

Thursday, March 24, 2011

Economic Development, Privatization & Subsidies

Wednesday, March 23, 2011

Tuesday, March 22, 2011

Not About The Budget

Visit msnbc.com for breaking news, world news, and news about the economy

The People Are Not With You

It's The Teachers' Fault...

The Unemployment Crisis

Sunday, March 20, 2011

Lyin' Ryan

Friday, March 18, 2011

Our Airwaves

We Want Our Government Back

Robbing Peter To Pay Paul

Thursday, March 17, 2011

Walker Doesn't Understand Basic Economics

In a column in the Washington Post this morning Walker noted that under his new compensation package for public sector employees in Wisconsin, workers in the state will still be paying a far smaller portion of their health care benefits than most workers in the private sector or federal employees. He then comments:

"It’s enough to make you wonder why there are no protesters circling the White House."

Actually, it's enough to make you wonder what Governor Walker could possibly be thinking.

Employer payments for pensions, health care coverage and other benefits are part of a total compensation package. It makes little difference to an employer whether they pay another dollar for health care or for wages. Public employees in Wisconsin had bargained for a compensation package that gave them lower wages than their private sector counterparts, but more generous benefits. Their total compensation package was still somewhat lower than for private sector workers with the same education and experience. When Governor Walker increased the amount that workers had to pay for their pensions and health insurance, he cut their pay pure and simple putting them further behind their private sector counterparts.

Governor Walker seems not to understand this simple fact. According to the logic of his column, a worker getting a salary of $40,000 a year with full health care benefits and an employer provided pension would be better off than a worker getting $200,000 a year and no benefits. Obviously this makes no sense. It would be good if one of Governor Walker's aides could explain this to him."

Wednesday, March 16, 2011

Tuesday, March 15, 2011

Sunday, March 13, 2011

A Capitol Idea

Private Delusions

- The number of state and local employees per 1,000 state residents was 8.2% below average, ranking 41st nationally.

- Total government spending at the state and local level in Wisconsin was $570 (6.1%) per person below the national average in 2007-08.

- State and local spending in Wisconsin in fiscal year 2008 was 4.4 percent below the national average when it is measured on a per capita basis.

- Total state and local taxes were $40 per person less in Wisconsin in FY 2008 than the national average, and Wisconsin ranked 17th in that category (compared to 8th in 2000).

Better Ways To Spend $36 Million

Wisconsin already allows a tremendously generous 30 percent exclusion for capital gains income, which ITEPestimates cost more than $150 million in 2010. The Governor is proposing two changes to how capital gains are currently taxed: “a 100 percent exclusion for capital gains realized on Wisconsin-based capital assets held for five or more years and a 100 percent capital gains tax deferral for gains reinvested in Wisconsin-based businesses.”

If implemented, these changes would cost the state about $36 million over the next two fiscal years. At a time when the state is facing a $3.6 billion dollar shortfall, surely there are better ways that $36 million could be used."

Coverage & Context

Saturday, March 12, 2011

More Right-Wing Fantasy & False Equivalence

Recoiling Retirement

- The short answer is that there's simply no evidence that state pensions are the current burden to public finances that their critics claim.

- Pension contributions from state and local employers aren't blowing up budgets. They amount to just 2.9 percent of state spending, on average, according to the National Association of State Retirement Administrators. The Center for Retirement Research at Boston College puts the figure a bit higher at 3.8 percent.

- The nonpartisan Employee Benefit Research Institute estimates that retirement funding for private employers amounts to about 3.5 percent of employee compensation.

- In 1980, 84 percent of workers at medium and large companies in the U.S. had a defined-benefit plan like those still predominate in the public sector. By last year, just 30 percent of workers in these larger companies were covered under such plans.

- Two out of every three public-sector workers aren't union members.

- Wisconsin's public-sector pension plan still has enough assets today to cover more than 18 years of benefits.

- Since September 2008_ when state and local government employees numbered 19,385,000 and the economic crisis turned severe — the governments' payrolls shrunk by 407,000, to 18,978,000 this January, according to Bureau of Labor Statistics data. When calculating from December 2007 _ the month that the National Bureau of Economic Research determined was the start of the Great Recession _ state and local government employment has fallen by 703,000 jobs amid a downturn that cost the nation more than 8 million jobs overall.

Tuesday, March 8, 2011

Park It

Still Inadequate

How Jobs Are Lost

Monday, March 7, 2011

Partisan A-Hole

We Have A REVENUE Problem

- Total individual income tax receipts fell 30 percent in real terms.

- Individual income taxes came to just $2,900 per capita in 2010, down 36 percent from more than $4,500 in 2000. Total income taxes and income taxes per capita declined even though the economy grew 16 percent overall and 6 percent per capita from 2000 through 2010.

- Corporate income tax receipts fell 27 percent and declined 34 percent per capita, even though profits boomed, rising 60 percent.

- As a share of GDP, income tax revenues are at their lowest level since 1951.

- The two-year growth rate [2010-2011] is almost one-third below the 3.6 percent average annual real growth rate for the half-century from 1950 to 2000, but it is better than the measly 1.6 percent growth rate from 2001 to 2009.

Saturday, March 5, 2011

Private Sector Piracy

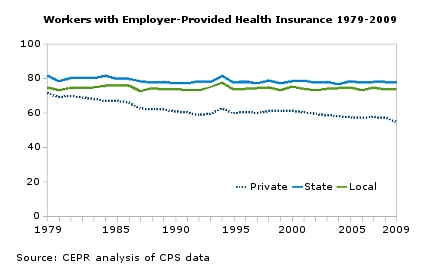

As an example, the figure here shows the share of workers in the private sector and in state and local governments that have employer-provided health insurance where the employer pays at least a portion of the premium. In 1979, the earliest year of data available, the private, state, and local sectors were not far apart. (Then, as now, state and local employees tend to be older and have more education, two factors that are highly correlated with better pay and benefits.) Over the next 30 years, the health-insurance coverage rates remained essentially unchanged for state and local government workers. But, the share of private-sector workers with employer-provided health insurance fell more than 15 percentage points --from over 70 percent to just under 55 percent.

State and local workers have been much more successful at retaining their benefits than private-sector workers. They have made concessions, including paying a higher share of their premiums, higher deductibles, and higher copays. But they have largely been able to maintain coverage for themselves and for their families. Private-sector workers, however, have had the rug pulled out from under them --by private-sector employers.

The higher unionization rate in the public sector has undoubtedly played a role. Over one-third of public-sector workers are in a union, compared with only about seven percent in the private sector. But, the union role has primarily been to hold state and local governments --and the much smaller share of unionized private-sector employers-- to the standard that these employers met before the 30-year assault on the American middle class that began in the late 1970s."

Putting Budgets & Wealth In Context

Another Way

Our Built Environment

Walker's Privatization Debacle

Visit msnbc.com for breaking news, world news, and news about the economy

The Great Republican Overreach

Visit msnbc.com for breaking news, world news, and news about the economy

Friday, March 4, 2011

Republican Bullshit

Visit msnbc.com for breaking news, world news, and news about the economy

Taxes & Spending

- Wisconsin went from 15th highest in 2000 to 27th in 2008 in state and local general revenue per capita, and from 13th to 23rd in total spending per capita.

- Total government spending at the state and local level in Wisconsin was $570 (6.1%) per person below the national average in 2007-08.

- In direct general spending, Wisconsin was $345 (4.4%) below the national average in per capita spending.

- Total state and local taxes were $40 per person less in Wisconsin in FY 2008 than the national average, and Wisconsin ranked 17th in that category (compared to 8th in 2000).

- On a per capita basis, Wisconsin ranks 46th in federal revenue, 17 percent below average.

- The number of state and local employees per 1,000 state residents was 8.2% below average, ranking 41st nationally.

- State and local spending for public employee payrolls was 9 percent below the national average and ranked 33rd.

- State and local spending in Wisconsin in fiscal year 2008 was 4.4 percent below the national average when it is measured on a per capita basis.

Just Sayin'

Leaf Me Alone

The Untouchable Complex

Hung Out To Dry

Everyone Lives In South Dakota

Thursday, March 3, 2011

Heads, You Lose; Tails, You Lose

Our Media Sucks!

Wednesday, March 2, 2011

Just A Bunch Of Slobs

Educate Yourself

The National Education Association's latest research indicates, "The average salary for Wisconsin teachers has dropped to 23rd nationally, down from 21st one year ago. That is the lowest ranking going back to 1963, the oldest data on record. The average salary, which includes annual step increases for longevity and lane changes for educational attainment, was $51,264. Fifty-two percent of Wisconsin teachers hold master’s degrees and the average teacher has 16 years experience. Once ranked 15th, teacher pay was capped in 1993 and has fallen ever since. Where teachers once received 103 percent of the national average in pay, they now receive only 93 percent. In the last decade, real earnings for Wisconsin teachers declined by 2.3 percent. Teachers earn less today than they did a decade ago. Wisconsin ranked 46th nationally in salary change, with 45 states experiencing larger increases in income. Wisconsin ranks 30th nationally on starting pay, lower than teachers in Illinois, Michigan, Ohio, Indiana, and Minnesota in the Midwest. Teachers in general have the lowest starting pay of any profession requiring a college degree. Wisconsin teachers today are in the bottom 40 percent of all states for starting pay."