Great vision and leadership were on display when Milwaukee County Executive Chris Abele addressed concerns that wealthier neighborhoods' parks are better maintained, "It's not hard to find parks in the inner city that haven't gotten much love in a while. It's a lot easier for parks in the suburbs or the North Shore to have friends groups," said Abele.

Yes, rich people have more money and thus more resources for parks. Truly inspired insight.

As County Executive, part of the job is gathering and redirecting resources where they are needed most in the community to ensure a good quality of life.

Yet, as Dan Cody shows, "When Milwaukee County took over the parks system in 1983, they allocated $41.6 million [$96.2 million in 2012 dollars] to the parks operating budget. The proposal this year: $42 million."

Of the 40 largest parks systems in the U.S., ParkScore ranked Milwaukee County Parks 16th. Spending per resident is $59.54.

For Further Reading:

2011 City Park Facts Report

"Those who make peaceful revolution impossible will make violent revolution inevitable." ~ John F. Kennedy

Saturday, September 29, 2012

Thursday, September 27, 2012

Paul Ryan: Wimp

If you (Paul Ryan) are unwilling to debate your opponent (Rob Zerban), to allow your constituents (and your opponent) to question you and to hear your views, you shouldn't even be allowed to run for public office.

Tommy Thompson: Liar

There they go again.

In their continuous effort to lie and mislead, the Republicans (on behalf of Tommy Thompson) are experiencing cognitive dissonance and also using completely debunked talking-points. In a new television ad for Thompson, they are purporting that Tammy Baldwin wants to cut Medicare by $716 billion and that the Republicans are the party that wants to save Medicare.

OK, first, the $716 billion "cut" is actually savings. This is the government not paying for useless procedures, snuffing out fraud, and not reimbursing ridiculous rates. Medicare isn't shrinking, nor are its recipients benefits decreasing, the amount merely refers to savings from controlling waste and fraud.

Second, Republicans want to end Medicare (not to mention Social Security). They are the ones coming up with plans to eliminate eligible recipients, to increase the eligible age, and to turn Medicare into a voucher program (which is a fancy way of saying you'll have to pay more).

It should be unlawful to broadcast such blatant lies...especially when it concerns electing public officials. (I believe Canada actually has such a policy.) But, as should be evident by now, lies are all the Republicans have to offer.

In their continuous effort to lie and mislead, the Republicans (on behalf of Tommy Thompson) are experiencing cognitive dissonance and also using completely debunked talking-points. In a new television ad for Thompson, they are purporting that Tammy Baldwin wants to cut Medicare by $716 billion and that the Republicans are the party that wants to save Medicare.

OK, first, the $716 billion "cut" is actually savings. This is the government not paying for useless procedures, snuffing out fraud, and not reimbursing ridiculous rates. Medicare isn't shrinking, nor are its recipients benefits decreasing, the amount merely refers to savings from controlling waste and fraud.

Second, Republicans want to end Medicare (not to mention Social Security). They are the ones coming up with plans to eliminate eligible recipients, to increase the eligible age, and to turn Medicare into a voucher program (which is a fancy way of saying you'll have to pay more).

It should be unlawful to broadcast such blatant lies...especially when it concerns electing public officials. (I believe Canada actually has such a policy.) But, as should be evident by now, lies are all the Republicans have to offer.

Monday, September 24, 2012

Saturday, September 22, 2012

Friday, September 21, 2012

Monday, September 17, 2012

Those Pesky Electrocution Rules

Walker Administration Target Electrical Safety Codes

"Mandatory requirements designed to detect fire-causing conditions, stop electric shocks and keep children from sticking foreign objects into electrical outlets have been targeted for removal from the state code."

"Mandatory requirements designed to detect fire-causing conditions, stop electric shocks and keep children from sticking foreign objects into electrical outlets have been targeted for removal from the state code."

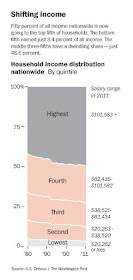

Romney Uncensored

"There are 47 percent of the people who will vote for the president no matter what. All right, there are 47 percent who are with him, who are dependent upon government, who believe that they are victims, who believe the government has a responsibility to care for them, who believe that they are entitled to health care, to food, to housing, to you-name-it. That that's an entitlement. And the government should give it to them. And they will vote for this president no matter what…These are people who pay no income tax. Romney went on: "[M]y job is is not to worry about those people. I'll never convince them they should take personal responsibility and care for their lives."

Sunday, September 16, 2012

We're Broke?

State gives $5 million to BMO Harris Bradley Center for repairs.

Yes, we are so broke.

Unless the already well-to-do and well-connected want millions for their private playgrounds.

Yes, we are so broke.

Unless the already well-to-do and well-connected want millions for their private playgrounds.

Saturday, September 15, 2012

Stock Update

The stock market has shown steady improvement over President Obama's first term.

Republicans are supposedly worried about the economy and businesses. (Just let them run the show again - they know how to create jobs!)

How can they claim the President is hurting business?

When you slam President Obama as being a socialist and for hating business, and when you obstruct all of his legislation, it's impossible to contort yourself around to then claim you're responsible for the things actually getting done. Republicans haven't supported anything the Democrats have proposed, but the right-wing is somehow responsible for the good outcomes?

The accused socialist and business-hater is good for business!

Corporate profits are at all-time highs. The Dow Jones is as high as it's been since 2008 (see chart below).

Yet, business doesn't like the President?

They don't appreciate the growth and the steady economic hand Barack Obama has demonstrated in helping the economy out of the ditch the Republicans drove it into?

Why? Oh, that's right...politics. Perpetuating the adult conversation we're not having. Thanks, Republicans.

[Source]

For Further Reading:

Barack's Increasing Stock

The Auto Industry And Labor Productivity

General Motors had $150.28 billion in revenues in 2011. General Motors has 202,000 employees. That's $743,960 revenue per employee. As David Leonhardt wrote, "The average GM, Ford and Chrysler worker receives compensation – wages, bonuses, overtime and paid time off – of about $40 an hour. Add in benefits such as health insurance and pensions and you get to about $55." If we use this $55 per hour number (for total compensation), which would gross roughly $114K per year, the typical GM worker only receives 16 percent of his revenue productivity.

People complain about taxes. But this is a direct example of how labor is taxed. In this case, at 84 percent! (And Republicans complain about 30, 20, and even 10 percent taxation?)

2011 Ford Revenues: $136.26 billion.

2011 Ford Employees: 164,000.

2011 Ford Revenue Per Employee: $830,854.

Labor Tax: 84%

2011 Chrysler Revenues: $55 billion.

2011 Chrysler Employees: 51,623.

2011 Chrysler Revenue Per Employee: $1,065,416.

Labor Tax: 89%.

Seeing as how the Republicans are so concerned with the average Joe and fair taxation, I know we'll be hearing from them any minute now about how we must obtain more just compensation for our auto workers.

People complain about taxes. But this is a direct example of how labor is taxed. In this case, at 84 percent! (And Republicans complain about 30, 20, and even 10 percent taxation?)

2011 Ford Revenues: $136.26 billion.

2011 Ford Employees: 164,000.

2011 Ford Revenue Per Employee: $830,854.

Labor Tax: 84%

2011 Chrysler Revenues: $55 billion.

2011 Chrysler Employees: 51,623.

2011 Chrysler Revenue Per Employee: $1,065,416.

Labor Tax: 89%.

Seeing as how the Republicans are so concerned with the average Joe and fair taxation, I know we'll be hearing from them any minute now about how we must obtain more just compensation for our auto workers.

Thursday, September 13, 2012

Crumbling Roads, Crumbling Democracy

Why is the economy continuing to only plod along? [But, yes, it is indeed better than it was 4 years ago.]

Why is unemployment looming stubbornly near 8 percent?

Paul Krugman explains:

"For future reference. In a depressed economy, with the government able to borrow at very low interest rates, we should be increasing public investment — the true cost of the resources is negligible, so the rate of return is very high, not to mention the desirability of creating jobs.

Here’s what has actually happened, as measured by the sum of state, local, and federal nondefense investment:

Doing it wrong."

Doing it wrong."

And, yes, Republican obstruction of all Obama's and the Democrat's jobs legislation has a lot to do with this.

According to Republicans, borrowing is bad, even though the cost of money is about as cheap as it gets. There isn't a better time to invest our infrastructure - mass transportation, water and sewer ways, the electric grid, the greening of public buildings, repairing bridges and roads, etc.

Also, according to Republicans, government-induced demand is a bad thing, although no one else (I'm looking at you, private sector) is willing to spend any money at the moment. Yes, for those of you being foreclosed upon, losing your job, already out of work, behind on your bills, you're just going to have to tough it out until the market decides you're worthy of saving.

Why is unemployment looming stubbornly near 8 percent?

Paul Krugman explains:

"For future reference. In a depressed economy, with the government able to borrow at very low interest rates, we should be increasing public investment — the true cost of the resources is negligible, so the rate of return is very high, not to mention the desirability of creating jobs.

Here’s what has actually happened, as measured by the sum of state, local, and federal nondefense investment:

And, yes, Republican obstruction of all Obama's and the Democrat's jobs legislation has a lot to do with this.

According to Republicans, borrowing is bad, even though the cost of money is about as cheap as it gets. There isn't a better time to invest our infrastructure - mass transportation, water and sewer ways, the electric grid, the greening of public buildings, repairing bridges and roads, etc.

Also, according to Republicans, government-induced demand is a bad thing, although no one else (I'm looking at you, private sector) is willing to spend any money at the moment. Yes, for those of you being foreclosed upon, losing your job, already out of work, behind on your bills, you're just going to have to tough it out until the market decides you're worthy of saving.

Whose Worse Off? U.S. or Europe?

Conservative Americans love to drone on and on about how the European welfare state is bankrupting them. As the story goes, their too-generous "entitlement" policies are dragging down the entire economy. Thus, we here in the U.S. must also eviscerate our "entitlements" and welfare policies, or we shall face the shame dire consequences.

As usual, with Republicans, nuance, context, and the better part of reality are left out the analysis.

"There's a strong tendency to think of it as having a lot to do with the fundamental inequalities in overall productivity and economic development between euro members — backward, semideveloped countries like Greece or Portugal (not my view, but what you often hear) awkwardly tied to powerhouses like Germany. So it comes as something of a shock to look at Eurostat data on real gross domestic product per capita (or productivity, which look similar). Sure, Greece and Portugal are relatively poor, with G.D.P. per capita of 82 and 77 percent, respectively, of the European Union average; this means roughly 76 and 71 percent of the euro zone average, since the euro countries are a bit richer than the E.U. as a whole. Meanwhile, Germany is at 120 percent of the E.U. average, or 112 percent of the euro zone average. But it's no different, really, than the situation in the United States. According to data from the Bureau of Economic Analysis, Alabama is at 74 percent of the average, Mississippi at 67 percent, with New England and the Middle Atlantic States at 118 and 116 percent. In other words, as far as underlying economic inequalities are concerned, the euro zone is no worse than the United States," as Paul Krugman details.

As usual, with Republicans, nuance, context, and the better part of reality are left out the analysis.

"There's a strong tendency to think of it as having a lot to do with the fundamental inequalities in overall productivity and economic development between euro members — backward, semideveloped countries like Greece or Portugal (not my view, but what you often hear) awkwardly tied to powerhouses like Germany. So it comes as something of a shock to look at Eurostat data on real gross domestic product per capita (or productivity, which look similar). Sure, Greece and Portugal are relatively poor, with G.D.P. per capita of 82 and 77 percent, respectively, of the European Union average; this means roughly 76 and 71 percent of the euro zone average, since the euro countries are a bit richer than the E.U. as a whole. Meanwhile, Germany is at 120 percent of the E.U. average, or 112 percent of the euro zone average. But it's no different, really, than the situation in the United States. According to data from the Bureau of Economic Analysis, Alabama is at 74 percent of the average, Mississippi at 67 percent, with New England and the Middle Atlantic States at 118 and 116 percent. In other words, as far as underlying economic inequalities are concerned, the euro zone is no worse than the United States," as Paul Krugman details.

Times are tough all around. These "worse off" hysterics are counterproductive and miss the point. We should be focusing on putting people back to work and not pointing fingers or worrying about whom is better off. A high debt as a percentage of GDP is nothing new. It's not optimal, but it's nothing new. We got ourselves out of this situation before by investing and putting people back to work. That same prescription will work again.

Are We "Printing Money"?

Conservatives have a talking-point about the Federal Reserve printing money. The U.S. is (supposedly) continually printing money, running up debt and fanning the flames of inflation. This is debasing the dollar and leading us, in general, toward calamity.

But the real problem is unemployment and its effects on economic growth and, thus, debt reduction. We have a demand-side problem, not a supply-side problem. The longer we go leaving millions without work and wasting their potential, the more we hurt not only them but the entire economy.

"One of the themes I’ve hit on many times is the fact that the crisis and slump have been a testing ground for economic doctrines. People came into this mess with very different views about how the economy works, and the crisis in effect provided natural experiments that tested those views. Most notably, what we got was a test of demand-side versus supply-side stories about the nature of depressions. Demand-siders like me saw this as very much a slump caused by inadequate spending: thanks largely to the overhang of debt from the bubble years, aggregate demand fell, pushing us into a classic liquidity trap. But many people — some of them credentialed economists — insisted that it was actually some kind of supply shock instead. Either they had an Austrian story in which the economy’s productive capacity was undermined by bad investments in the boom, or they claimed that Obama’s high taxes and regulation had undermined the incentive to work (of course, Obama didn’t actually impose high taxes or onerous regulations, but leave that aside for now). How could you tell which story was right? One answer was to look at the behavior of interest rates; the other was to look at inflation. For if you believed a demand-side story, you would also believe that even a large monetary expansion would have little inflationary effect; if you believed a supply-side story, you would expect lots of inflation from too much money chasing a reduced supply of goods. And indeed, people on the right have been forecasting runaway inflation for years now. Yet the predicted inflation keeps not coming," notes Paul Krugman.

Krugman also states, "What’s wrong with the idea that running the printing presses is a giveaway to plutocrats? Let me count the ways. First, as Joe Wiesenthal and Mike Konczal both point out, the actual politics is utterly the reverse of what’s being claimed. Quantitative easing isn’t being imposed on an unwitting populace by financiers and rentiers; it’s being undertaken, to the extent that it is, over howls of protest from the financial industry. I mean, where are the editorials in the WSJ demanding that the Fed raise its inflation target? Beyond that, let’s talk about the economics. The naive (or deliberately misleading) version of Fed policy is the claim that Ben Bernanke is “giving money” to the banks. What it actually does, of course, is buy stuff, usually short-term government debt but nowadays sometimes other stuff. It’s not a gift. To claim that it’s effectively a gift you have to claim that the prices the Fed is paying are artificially high, or equivalently that interest rates are being pushed artificially low. And you do in fact see assertions to that effect all the time. But if you think about it for even a minute, that claim is truly bizarre. I mean, what is the un-artificial, or if you prefer, “natural” rate of interest? As it turns out, there is actually a standard definition of the natural rate of interest, coming from Wicksell, and it’s basically defined on a PPE basis (that’s for proof of the pudding is in the eating). Roughly, the natural rate of interest is the rate that would lead to stable inflation at more or less full employment. And we have low inflation with high unemployment, strongly suggesting that the natural rate of interest is below current levels, and that the key problem is the zero lower bound which keeps us from getting there. Under these circumstances, expansionary Fed policy isn’t some kind of giveway to the banks, it’s just an effort to give the economy what it needs. Furthermore, Fed efforts to do this probably tend on average to hurt, not help, bankers. Banks are largely in the business of borrowing short and lending long; anything that compresses the spread between short rates and long rates is likely to be bad for their profits. And the things the Fed is trying to do are in fact largely about compressing that spread, either by persuading investors that it will keep short rates at zero for a longer time or by going out and buying long-term assets. These are actions you would expect to make bankers angry, not happy — and that’s what has actually happened.

As Dean Baker explained, "In normal times, the economy is, at least partially, supply-constrained. Collectively, we want more goods and services than the economy is capable of producing.... In our demand-constrained economy, how- ever, there is no problem of inflation. The economy can produce more of almost anything right now. The reason that we are not doing it is simply the lack of demand."

Krugman elaborates, "Surely we don’t mean to identify money with pieces of green paper bearing portraits of dead presidents. Even Milton Friedman rejected that, more than half a century ago. For one thing, a lot of those pieces of green paper are pretty much inert — sitting outside the United States, in the hoards of drug dealers and such. For another, checking accounts are clearly a close substitute for cash in hand. Friedman and Schwartz dealt with this by proposing broader aggregates –M1, which adds checking accounts, and M2, which adds a broader range of deposits. And circa 1960 you could argue that those aggregates were good enough. But now we have a large shadow banking system, in which things like repo serve much the same function as deposits; M3 used to capture some of that, but the Fed discontinued it, in part I think because it wasn’t clear which repo belonged there, and data on repo not involving primary dealers is scattered. Whatever. The truth is that these days — with credit cards, electronic money, repo, and more all serving the purpose of medium of exchange — it’s not clear that any single number deserves to be called “the” money supply. Intellectually, this isn’t a problem; nor is there necessarily a problem maintaining monetary policy even if there isn’t any single thing you’re willing to call money. Mike Woodford has been writing about this stuff for years. But if you’re determined to view economic affairs through a sort of paleo-monetarist lens, focused on the evils of “printing money”, you’re going to have a hard time in the modern world, where the definition of money is increasingly vague."

We still have a world more than willing to buy U.S. debt (the dollar is still the world currency and the preferred store of value) and inflation is nowhere in sight.

Here, again, we have the Republicans bloviating to justify their own interests, their discredited worldview, and to enable policies benefiting their cronies. But none of their ideas have anything to do with reality. Yet another talking-point of the right-wing which you would be wise to ignore.

But the real problem is unemployment and its effects on economic growth and, thus, debt reduction. We have a demand-side problem, not a supply-side problem. The longer we go leaving millions without work and wasting their potential, the more we hurt not only them but the entire economy.

"One of the themes I’ve hit on many times is the fact that the crisis and slump have been a testing ground for economic doctrines. People came into this mess with very different views about how the economy works, and the crisis in effect provided natural experiments that tested those views. Most notably, what we got was a test of demand-side versus supply-side stories about the nature of depressions. Demand-siders like me saw this as very much a slump caused by inadequate spending: thanks largely to the overhang of debt from the bubble years, aggregate demand fell, pushing us into a classic liquidity trap. But many people — some of them credentialed economists — insisted that it was actually some kind of supply shock instead. Either they had an Austrian story in which the economy’s productive capacity was undermined by bad investments in the boom, or they claimed that Obama’s high taxes and regulation had undermined the incentive to work (of course, Obama didn’t actually impose high taxes or onerous regulations, but leave that aside for now). How could you tell which story was right? One answer was to look at the behavior of interest rates; the other was to look at inflation. For if you believed a demand-side story, you would also believe that even a large monetary expansion would have little inflationary effect; if you believed a supply-side story, you would expect lots of inflation from too much money chasing a reduced supply of goods. And indeed, people on the right have been forecasting runaway inflation for years now. Yet the predicted inflation keeps not coming," notes Paul Krugman.

Krugman also states, "What’s wrong with the idea that running the printing presses is a giveaway to plutocrats? Let me count the ways. First, as Joe Wiesenthal and Mike Konczal both point out, the actual politics is utterly the reverse of what’s being claimed. Quantitative easing isn’t being imposed on an unwitting populace by financiers and rentiers; it’s being undertaken, to the extent that it is, over howls of protest from the financial industry. I mean, where are the editorials in the WSJ demanding that the Fed raise its inflation target? Beyond that, let’s talk about the economics. The naive (or deliberately misleading) version of Fed policy is the claim that Ben Bernanke is “giving money” to the banks. What it actually does, of course, is buy stuff, usually short-term government debt but nowadays sometimes other stuff. It’s not a gift. To claim that it’s effectively a gift you have to claim that the prices the Fed is paying are artificially high, or equivalently that interest rates are being pushed artificially low. And you do in fact see assertions to that effect all the time. But if you think about it for even a minute, that claim is truly bizarre. I mean, what is the un-artificial, or if you prefer, “natural” rate of interest? As it turns out, there is actually a standard definition of the natural rate of interest, coming from Wicksell, and it’s basically defined on a PPE basis (that’s for proof of the pudding is in the eating). Roughly, the natural rate of interest is the rate that would lead to stable inflation at more or less full employment. And we have low inflation with high unemployment, strongly suggesting that the natural rate of interest is below current levels, and that the key problem is the zero lower bound which keeps us from getting there. Under these circumstances, expansionary Fed policy isn’t some kind of giveway to the banks, it’s just an effort to give the economy what it needs. Furthermore, Fed efforts to do this probably tend on average to hurt, not help, bankers. Banks are largely in the business of borrowing short and lending long; anything that compresses the spread between short rates and long rates is likely to be bad for their profits. And the things the Fed is trying to do are in fact largely about compressing that spread, either by persuading investors that it will keep short rates at zero for a longer time or by going out and buying long-term assets. These are actions you would expect to make bankers angry, not happy — and that’s what has actually happened.

As Dean Baker explained, "In normal times, the economy is, at least partially, supply-constrained. Collectively, we want more goods and services than the economy is capable of producing.... In our demand-constrained economy, how- ever, there is no problem of inflation. The economy can produce more of almost anything right now. The reason that we are not doing it is simply the lack of demand."

Krugman elaborates, "Surely we don’t mean to identify money with pieces of green paper bearing portraits of dead presidents. Even Milton Friedman rejected that, more than half a century ago. For one thing, a lot of those pieces of green paper are pretty much inert — sitting outside the United States, in the hoards of drug dealers and such. For another, checking accounts are clearly a close substitute for cash in hand. Friedman and Schwartz dealt with this by proposing broader aggregates –M1, which adds checking accounts, and M2, which adds a broader range of deposits. And circa 1960 you could argue that those aggregates were good enough. But now we have a large shadow banking system, in which things like repo serve much the same function as deposits; M3 used to capture some of that, but the Fed discontinued it, in part I think because it wasn’t clear which repo belonged there, and data on repo not involving primary dealers is scattered. Whatever. The truth is that these days — with credit cards, electronic money, repo, and more all serving the purpose of medium of exchange — it’s not clear that any single number deserves to be called “the” money supply. Intellectually, this isn’t a problem; nor is there necessarily a problem maintaining monetary policy even if there isn’t any single thing you’re willing to call money. Mike Woodford has been writing about this stuff for years. But if you’re determined to view economic affairs through a sort of paleo-monetarist lens, focused on the evils of “printing money”, you’re going to have a hard time in the modern world, where the definition of money is increasingly vague."

We still have a world more than willing to buy U.S. debt (the dollar is still the world currency and the preferred store of value) and inflation is nowhere in sight.

Here, again, we have the Republicans bloviating to justify their own interests, their discredited worldview, and to enable policies benefiting their cronies. But none of their ideas have anything to do with reality. Yet another talking-point of the right-wing which you would be wise to ignore.

Sunday, September 9, 2012

The "Uncertainty" Myth

Medicare & Social Security

Let's clear up some false claims (by Republicans) regarding two popular government programs - Medicare and Social Security.

According to Republicans, both are insolvent and headed for destruction. Republicans simply want to funnel this public money to Big Insurance and Wall Street - private insurance and 401Ks - the privatization of medical care and retirement.

Although, reality actually shows use that Medicare has controlled health care costs more than the private sector. And, Social Security has provided a more stable retirement than 401Ks.

Medicare has long-term solvency issues. But this is not because of some inherent problem with the program itself. It has to do with the fact that our health care is incredibly expensive and inefficient. We pay twice as much as the next country, and we don't get better results. This means controlling costs, clamping down on fraud, removing Big Pharma's grasp on overpriced medicine, and preventing unnecessary procedures and testing.

[source]

Social Security (as Dean Baker has exhaustively detailed in repeated articles) is, comparatively speaking, fine. The program is solvent for decades, even if we do nothing. Then, decades down the road, the program (if nothing is done) will still be able to pay 80 percent of promised benefits. Republicans claim, because so many baby boomers are retiring, increasing retirees will bankrupt the system. Again, it seems, the arithmetic is too difficult for Republicans.

First, this increase in the number of retirees was addressed by an increased payroll tax put in place in the 1980s. Second, workers today are more productive and also earn more. Thus, we don't need the same number of workers to support each retiree. Less workers can support more retirees. Removing the cap on taxable income in itself would solve any supposed shortfall.

So, if we remove the private sector (the fraud, the unnecessarily high costs) from medical care, much of the bloated and wasteful spending disappears and, thus, Medicare's long-term solvency greatly improves. And, the idea, being pushed by Republicans, that anything, at this time, needs to be done to Social Security is merely scare tactics.

Don't let Republican lies, greed and scare tactics destroy two of Government's greatest achievements - Medicare and Social Security.

According to Republicans, both are insolvent and headed for destruction. Republicans simply want to funnel this public money to Big Insurance and Wall Street - private insurance and 401Ks - the privatization of medical care and retirement.

Although, reality actually shows use that Medicare has controlled health care costs more than the private sector. And, Social Security has provided a more stable retirement than 401Ks.

Medicare has long-term solvency issues. But this is not because of some inherent problem with the program itself. It has to do with the fact that our health care is incredibly expensive and inefficient. We pay twice as much as the next country, and we don't get better results. This means controlling costs, clamping down on fraud, removing Big Pharma's grasp on overpriced medicine, and preventing unnecessary procedures and testing.

[source]

[source]

[source]

[source]

Social Security (as Dean Baker has exhaustively detailed in repeated articles) is, comparatively speaking, fine. The program is solvent for decades, even if we do nothing. Then, decades down the road, the program (if nothing is done) will still be able to pay 80 percent of promised benefits. Republicans claim, because so many baby boomers are retiring, increasing retirees will bankrupt the system. Again, it seems, the arithmetic is too difficult for Republicans.

First, this increase in the number of retirees was addressed by an increased payroll tax put in place in the 1980s. Second, workers today are more productive and also earn more. Thus, we don't need the same number of workers to support each retiree. Less workers can support more retirees. Removing the cap on taxable income in itself would solve any supposed shortfall.

So, if we remove the private sector (the fraud, the unnecessarily high costs) from medical care, much of the bloated and wasteful spending disappears and, thus, Medicare's long-term solvency greatly improves. And, the idea, being pushed by Republicans, that anything, at this time, needs to be done to Social Security is merely scare tactics.

Don't let Republican lies, greed and scare tactics destroy two of Government's greatest achievements - Medicare and Social Security.

Jobs: Bush Versus Obama

From Think Progress, "Private sector job creation under President Obama has far exceeded private sector job creation under President Bush. 40 months into his presidential term, there are currently more private sector jobs in the economy than when Obama came into office. At the same point in President Bush’s term, the total number of private sector jobs was still down 1.7 percent from where it began.

The numbers are even starker when measuring each president’s record from the moment job creation returned. Private sector job creation returned in February of 2010, the 13th month of President Obama’s term. Since then, the economy has added 4.3 million private sector jobs, a 4 percent increase.

Under President Bush, the economy stopped shedding private sector jobs in July of 2003, fully 30 months into his administration. From that point until May of 2004, the economy added just 1.5 million private sector jobs, an increase of only 1.4 percent."

The numbers are even starker when measuring each president’s record from the moment job creation returned. Private sector job creation returned in February of 2010, the 13th month of President Obama’s term. Since then, the economy has added 4.3 million private sector jobs, a 4 percent increase.

Under President Bush, the economy stopped shedding private sector jobs in July of 2003, fully 30 months into his administration. From that point until May of 2004, the economy added just 1.5 million private sector jobs, an increase of only 1.4 percent."

Andrew Leonard notes, "But the real eye-opener comes when we compare Obama’s numbers to George W. Bush’s. In Bush’s first term, the economy shed 913,000 private sector jobs! 913,000! The only thing that saved Bush’s first term from being a complete economic disaster, in terms of employment, was robust public sector growth: The economy added 900,000 government jobs. One wonders: Without the massive growth in the public sector during Bush’s first term, would he have been reelected?"

The only thing that didn't make Bush's first term job creation numbers a complete disaster was the growth of public workers - the government. Obama accomplished much better total job growth in his first term, even with an unprecedented decline in the number of public workers.

And, in general, the economy creates more jobs under Democrats - 42 million during Democratic administrations versus 24 million during Republican administrations.

Whichever period we choose to dissect, we can see the country is better off under the Democrats. Plus, the idea that President Obama has performed poorly is highly misguided. No doubt, we'd all rather see more robust job creation, to bring the unemployment rate down toward a more respectable 5 or 6 percent. But, if the millions of jobs created in Obama's first term is some colossal failure, then the nonexistent job growth during Bush's first term is the absolute worst performance we've ever seen. This is surely not an endorsement for giving the White House back to the Republicans whom have performed so comparatively poorly.

So, if the economy is the important issue we all should be focused on during this election (as Republicans seem to indicate), based on their past performance versus the current President's performance, the only choice is Barack Obama.

Saturday, September 8, 2012

Monday, September 3, 2012

Saturday, September 1, 2012

The Mitt Romney Story

The Colbert Report

Get More: Colbert Report Full Episodes,Political Humor & Satire Blog,Video Archive

Get More: Colbert Report Full Episodes,Political Humor & Satire Blog,Video Archive

The Colbert Report

Get More: Colbert Report Full Episodes,Political Humor & Satire Blog,Video Archive

Get More: Colbert Report Full Episodes,Political Humor & Satire Blog,Video Archive

Ayn Rand & Paul Ryan

The Colbert Report

Get More: Colbert Report Full Episodes,Political Humor & Satire Blog,Video Archive

Get More: Colbert Report Full Episodes,Political Humor & Satire Blog,Video Archive