Small Government Conservatives...When It's Convenient

"Those who make peaceful revolution impossible will make violent revolution inevitable." ~ John F. Kennedy

Tuesday, February 28, 2012

There He Goes Again

After cramming through instituting a budget that has hurt children, seniors, the poor, Wisconsin businesses, Wisconsin schools, job seekers, and pretty much the whole state, Scott Walker is now very worried about what effect the recall election will have on seniors and children.

If I wasn't living through the absurdity of Scott Walker attempting to govern I wouldn't believe such a doofus could exist.

For Further Reading:

Think Of The Children & Seniors

Walker's Budget Harms Seniors

Walker Budget Slashes Tax Credits That Aid The Poor

Walker Budget Slashes Medicaid

Walker To Use Foreclosure Settlement To "Balance" Budget

Walker's Budget Impact On Women And Girls

Walker's Budget Hurts Middle Class Families

Walker's Record Of Failure

If I wasn't living through the absurdity of Scott Walker attempting to govern I wouldn't believe such a doofus could exist.

For Further Reading:

Think Of The Children & Seniors

Walker's Budget Harms Seniors

Walker Budget Slashes Tax Credits That Aid The Poor

Walker Budget Slashes Medicaid

Walker To Use Foreclosure Settlement To "Balance" Budget

Walker's Budget Impact On Women And Girls

Walker's Budget Hurts Middle Class Families

Walker's Record Of Failure

Sunday, February 26, 2012

Sunday Reading

Competitiveness Is About Capital Much More Than Labor

Decades Of Decline In Employer-Sponsored Health Insurance Coverage

Gary Oldman

Medicaid's Big Spenders, In One Chart

No Shortage Of Rental Housing, Rents Not Rising Rapidly

Representatives & Senators: Trends In Member Characteristics Since 1945

Right-Wing Plot To Undermine Science In Public Schools

SuperPAC-Men Playing For Big Payday

The 10 Worst Things About The Oscars

Universities In Innovation Networks

You're Not Paying The Tax Rate You Think You Are

Decades Of Decline In Employer-Sponsored Health Insurance Coverage

Gary Oldman

Medicaid's Big Spenders, In One Chart

No Shortage Of Rental Housing, Rents Not Rising Rapidly

Representatives & Senators: Trends In Member Characteristics Since 1945

Right-Wing Plot To Undermine Science In Public Schools

SuperPAC-Men Playing For Big Payday

The 10 Worst Things About The Oscars

Universities In Innovation Networks

You're Not Paying The Tax Rate You Think You Are

Target(ing) Unions

Looks like we (living-wage and Labor-friendly individuals) have another anti-union business to boycott -- Target.

Saturday, February 25, 2012

The Right To Have Your Labor Exploited

37 state legislatures are attempting to pass anti-union, anti-labor right-to-work bills. The race to the bottom continues. This -- right-to-work legislation -- will lead to lower wages, less health care coverage, and more retirement volatility.

For Further Reading:

Does Right-To-Work Create Jobs?

Right To Work For Less

Right To Work Lowers Wages

What's Wrong With Right-To-Work?

Working Hard To Make Indiana Look Bad

For Further Reading:

Does Right-To-Work Create Jobs?

Right To Work For Less

Right To Work Lowers Wages

What's Wrong With Right-To-Work?

Working Hard To Make Indiana Look Bad

Milwaukee Real Estate

Multifamily Property Sales Prices

Office Property Sales Prices

"For office properties, the average sale price per square foot has risen to $37.81, a 1.4% increase compared to the end of last quarter. However, this is not a trend for the year, as sale prices have dipped by 26.1%. Despite being down for the year, the median sale price per square foot for office properties in the metro area has been rising for that past seven months. Over the past three years, the median sale price was at its highest in March 2009 at $89.33. The current median sale price is 57.7% lower. However, the current price is 11% higher than the three-year-low set in July 2011."

Retail Property Sales Prices

"At $60.71, sale prices per square foot for retail properties have decreased by 3.3% compared to the end of the prior quarter. Likewise, sale prices have dipped for the year, showing a 25.5% decrease. The median sale price of metro retail properties has been declining for seven consecutive months. When the streak began in July 2011, the median price was $71.62. The median price for the metro area hit its three-year low this month. The previous low was $62.76, set last month."

Office Property Asking Rent

"Lease rates for office properties have risen 0.9% versus the end of last quarter to $14.45 per square foot. Asking lease rates have risen 2.9% on the year. In March 2009, the lease rates for office properties were at their highest in the past three years at $14.72 per square foot. The current median asking lease rate is 1.8% lower. The lowest asking lease rate in the past three years was $13.96 set in February 2011."

Retail Property Asking Rent

"The average asking lease rate for retail properties in the metro area for the month was $14.53 per square foot. This represents a decrease of 3.3% year-over-year as well as a decrease of 0.4% compared to the end of the fourth quarter of 2011. This month, asking rates for retail properties have fallen to a new three-year low. The previous three-year low was last month at $14.59."

[Source: Loopnet]

Wisconsin Republicans Repealing Equal Pay Act

Amanda Terkel reports, "The Equal Pay Enforcement Act was meant to deter employers from discriminating by giving workers more avenues to press charges. Among other provisions, it allows individuals to plead their cases in the less costly, more accessible state circuit court system, rather than just in federal court.

In November, the state Senate approved (SB 202) rolling back this provision. On Wednesday, the Assembly did the same. Both were party-line votes. The legislation is now in the hands of Gov. Scott Walker (R). His office did not return a request for comment on whether the governor would sign it."

In November, the state Senate approved (SB 202) rolling back this provision. On Wednesday, the Assembly did the same. Both were party-line votes. The legislation is now in the hands of Gov. Scott Walker (R). His office did not return a request for comment on whether the governor would sign it."

Tuesday, February 21, 2012

The U.S, Debt & Households

In the media, when trying to practice "The Sky Is Falling" journalism (which is often), you'll see it said that the U.S. should act like a household. They shouldn't be in debt. They should balance their budget. They can't spend more than they take in. If the U.S. doesn't heed these warnings, Armageddon isn't far away.

Inspirational fear mongering aside, most U.S households don't to any of these prescriptions.

67% of U.S. homeowners have a mortgage. The median value for a home in the U.S. is $171,000. Per capita income is $26,000. So, let's assume the typical household with two adults is earning $52,000 per year. With a mortgage on eighty percent of the median home value, this is indebtedness of 2.6 times annual household earnings. And, this is just the house. Most households also have car, credit card, and medical debt.

The United States has a $15 trillion dollar economy. U.S debt is also estimated at $15 trillion. As a whole, the country is breaking even. Now a surplus would be nice, but compared to the typical U.S. household (in debt at least 2.6 times more than they earn, on average), breaking even seems pretty nice.

Inspirational fear mongering aside, most U.S households don't to any of these prescriptions.

67% of U.S. homeowners have a mortgage. The median value for a home in the U.S. is $171,000. Per capita income is $26,000. So, let's assume the typical household with two adults is earning $52,000 per year. With a mortgage on eighty percent of the median home value, this is indebtedness of 2.6 times annual household earnings. And, this is just the house. Most households also have car, credit card, and medical debt.

The United States has a $15 trillion dollar economy. U.S debt is also estimated at $15 trillion. As a whole, the country is breaking even. Now a surplus would be nice, but compared to the typical U.S. household (in debt at least 2.6 times more than they earn, on average), breaking even seems pretty nice.

Walker's Bogus Budget

Rick Ungar chronicles the sordid details of Scott Walker's "attempt" at budgeting.

"In a letter sent by Mike Huebsch, Walker’s Administration Secretary, to the U.S. Department of Health & Human Services just two months ago, Huebsch disclosed that the state of Wisconsin would have an ‘undisclosed deficit’ from January, 2012 through June, 2013...

Let’s begin with why Walker would want to go on record with his letter to HHS claiming a deficit while, at the same time, campaigning on a message that tells a very different story. Federal law allows a state to remove people from the state’s Medicaid rolls only in the circumstance where the state can show that it is suffering deficits...All so he can hold onto the opportunity to place more than 50,000 Wisconsinites in danger of losing their only access to health care...

There are, essentially, two accepted methods of accounting. There is the “cash method”— the one utilized by the Wisconsin legislature and Gov. Walker in creating their balanced budget—which accounts for how much money is in the bank at the end of the fiscal year after bills have been paid. As a result, cash accounting rarely presents a true picture of an organization’s finances—which is precisely why every public company in America, along with most city and country units of government, are required to use the GAAP method. GAAP (the acronym for Generally Accepted Accounting Practices) accounting takes into consideration the money expected to come in and the money committed to going out in order to work out where an organization actually stands...

"In a letter sent by Mike Huebsch, Walker’s Administration Secretary, to the U.S. Department of Health & Human Services just two months ago, Huebsch disclosed that the state of Wisconsin would have an ‘undisclosed deficit’ from January, 2012 through June, 2013...

Let’s begin with why Walker would want to go on record with his letter to HHS claiming a deficit while, at the same time, campaigning on a message that tells a very different story. Federal law allows a state to remove people from the state’s Medicaid rolls only in the circumstance where the state can show that it is suffering deficits...All so he can hold onto the opportunity to place more than 50,000 Wisconsinites in danger of losing their only access to health care...

There are, essentially, two accepted methods of accounting. There is the “cash method”— the one utilized by the Wisconsin legislature and Gov. Walker in creating their balanced budget—which accounts for how much money is in the bank at the end of the fiscal year after bills have been paid. As a result, cash accounting rarely presents a true picture of an organization’s finances—which is precisely why every public company in America, along with most city and country units of government, are required to use the GAAP method. GAAP (the acronym for Generally Accepted Accounting Practices) accounting takes into consideration the money expected to come in and the money committed to going out in order to work out where an organization actually stands...

What Walker is doing here is using the cash method of accounting to form the basis of his claims as stated in his advertisement while using GAAP accounting when making his claim to the Feds...

It seems that while Governor Walker now chooses to use cash basis accounting rather than a more honest representation of the state’s finances—at least when reporting his results to the people of Wisconsin—Candidate Walker saw it very differently. In fact, in 2010, Walker vigorously campaigned on the importance of ridding the state of this distorted method of accounting, going so far as to state on his campaign website that he would 'Require the use of generally accepted accounting principles (GAAP) to balance every state budget, just as we require every local government and school district to do.'"

It seems that while Governor Walker now chooses to use cash basis accounting rather than a more honest representation of the state’s finances—at least when reporting his results to the people of Wisconsin—Candidate Walker saw it very differently. In fact, in 2010, Walker vigorously campaigned on the importance of ridding the state of this distorted method of accounting, going so far as to state on his campaign website that he would 'Require the use of generally accepted accounting principles (GAAP) to balance every state budget, just as we require every local government and school district to do.'"

Federal Employee Compensation

Unionized workers with only a high school diploma earn, roughly, 20 percent more than their private sector counterparts. When we consider age, education, and experience, public sector workers with at least an Bachelors degree, earn less than their private sector counterparts. These are the conclusions of three recent studies (here, here and here). The Congressional Budget Office's latest research on the topic (looking at Federal employees) has found similar results.

"CBO's study compares federal civilian employees and private-sector employees with certain similar observable characteristics. This analysis focuses on wages, benefits, and total compensation between 2005 and 2010."

"CBO's study compares federal civilian employees and private-sector employees with certain similar observable characteristics. This analysis focuses on wages, benefits, and total compensation between 2005 and 2010."

- Federal civilian workers with no more than a high school education earned about 21 percent more, on average, than similar workers in the private sector.

- Workers whose highest level of education was a bachelor's degree earned roughly the same hourly wages, on average, in both the federal government and the private sector.

- Federal workers with a professional degree or doctorate earned about 23 percent less, on average, than their private-sector counterparts.

For Further Reading:

Thursday, February 16, 2012

Saturday, February 11, 2012

The Real Food Stamp President(s)

"Setting the record straight. Can you guess which president owns the first chart, about the increase in people who get food stamps, and which president owns the second one, about the rising cost of the program. I'm not going to tell you the answers, but I will give you two hints. There is a father and son in the answers, and neither is named Barack Obama."

h/t Crooks & Liars

CEO Pay, Unionization & The Middle Class

Union Membership Since 1983

Union Affiliation, Private Industries & Government

Union Membership Rate By State

Union Membership; Middle Class Share of Income

As union membership declines, so does the middle class.

Further Reading - Unionization:

Ratio CEO Compensation To Average Worker

The Top 1 Percent's Share of National Income

Further Reading - CEO Pay:

America's 25 Highest Paid CEOsCEO Pay

The CEO Pay Slice

CEO Pay Took Off While Middle Class Struggled

CEOs Distance Themselves From Average Worker

Corporate Paywatch

Pay Disparity Ratio

Wall Street Ascendant

Wall Street Class Racket

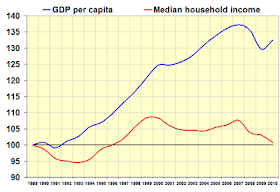

U.S Median Household Income

Further Reading - Inequality:

Sunday, February 5, 2012

Employment Readings

Alternative Measures Of Labor Utilization

Comparing Recessions & Recoveries

Down & Out

Eleven Telling Charts From 2011

Employment Population Ratio

The Employment Situation

Lies, Damned Lies, And Politics

1 Million People Didn't Drop Out Of Labor Force Last Month

Right-Wing Relying On Discredited Information

Wow. But Is The Number Real?

Comparing Recessions & Recoveries

Down & Out

Eleven Telling Charts From 2011

Employment Population Ratio

The Employment Situation

Lies, Damned Lies, And Politics

1 Million People Didn't Drop Out Of Labor Force Last Month

Right-Wing Relying On Discredited Information

Wow. But Is The Number Real?

Sunday Reading

Comparing Recessions & Recoveries

Dissecting Romney's Statement

Fantastic News On Jobs

It Pays To Be Rich

Koch Brothers & Allies Pledge $100 Million To Beat Obama

The One Percent Versus The Twenty Percent

Private Equity & "Job Creation"

Rachel Maddow Mocks Mitt Romney

Romney's Gift From Congress

Soaking The Poor, State By State

Why Don't We Pay People Enough?

Why The GOP Should Stop Invoking Reaganomics

Why The Super Bowl Is Socialist

Dissecting Romney's Statement

Fantastic News On Jobs

It Pays To Be Rich

Koch Brothers & Allies Pledge $100 Million To Beat Obama

The One Percent Versus The Twenty Percent

Private Equity & "Job Creation"

Rachel Maddow Mocks Mitt Romney

Romney's Gift From Congress

Soaking The Poor, State By State

Why Don't We Pay People Enough?

Why The GOP Should Stop Invoking Reaganomics

Why The Super Bowl Is Socialist

Saturday, February 4, 2012

Jobs

Mitt Romney feels President Obama has made the recession worse.

The latest jobs numbers dispute this fantasy.

John Boehner conceded the latest jobs figures were good, but claims Republican can do better.

To the graphical record:

The latest jobs numbers dispute this fantasy.

John Boehner conceded the latest jobs figures were good, but claims Republican can do better.

To the graphical record:

Since George W. Bush had the worst record for job creation of any president, the claim by Republicans that they know how to create jobs also falls flat. President Obama, in the first three years of his first term, has created more jobs than Bush created over his entire two terms.

President Obama (with 23 consecutive months of private sector job growth) hasn't made things worse, and we have recent historical evidence debunking the claim Republicans can do better. Their policies drove the car into the ditch, Obama has had to get it out. Let's not give the wheel back to the Republicans.